Protection and Indemnity (P&I) clubs sought further price improvements at the February 2024 renewals in order to keep up with claims inflation, despite a relatively benign year for P&I claims in 2023, according to a report from AM Best.

The P&I segment is dominated by 12 members of the International Group of P&I Clubs, which collectively insure approximately 90% of the world’s ocean-going tonnage. Through these P&I clubs, shipowners pool their insurance premiums to pay claims on a mutual basis.

In advance of the Feb. 20, 2024 renewal date, seven clubs announced they would apply a 7.5% increase to P&I premium rates, while five applied a 5% increase. It was the fifth consecutive year of general increases, which were required in order “to keep pace with claims inflation,” said the AM Best report, titled “P&I Clubs: Improving Underwriting Results but Further General Increases Needed to Keep Up With Inflation.”

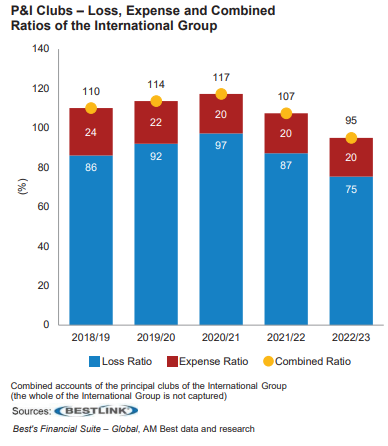

The report said the 2022/2023 period was the first year of combined underwriting profits for the 12 member clubs since 2016/2017.

AM Best noted that the general increases were slightly below those of the previous year when some of the clubs asked for increases up to 10%. (The rating agency said that P&I price increases are referred to as “general increases,” as “minimum target adjustments,” “target increases” or “internal targets.”)

“AM Best considers the level of general increases necessary for clubs to maintain the breakeven underwriting results seen in 2022/23 and expected for 2023/24, in the face of inflationary economic conditions and the potential for a worse pool year to emerge in the future.”

Most of the clubs have attained adequate price levels and their financial results are improving, so there should be less need for substantial rate adjustments in future renewals, the report added. “However, some level of increase may continue to offset the impact of inflation on claims and expenses.”

AM Best said that renewals over the past few years have been “increasingly informed by analysis of individual loss records and risk exposures.” In addition, member-specific pricing adjustments are also imposed by clubs when they apply their general increases. (In other words, loss-affected accounts have higher premiums).

Improved Results

During the 2022/2023 financial year, the International Group reported an underwriting surplus of US$152 million, a significant improvement from the previous year when a deficit of US$267 million was reported. In addition, the International Group’s combined ratio improved to 95% during 2022/23 from 107% during the previous financial year. (Combined ratios below 100 indicate an underwriting profit).

For 2023/2024, AM Best said it expects underwriting performance to be in line with 2022/23, with most clubs likely to achieve around breakeven combined ratios. While the general increases applied by the clubs have been offset by inflation-related hikes in cost and negative run-off on prior year claims, AM Best said, “current-year claims have remained in line or below budget for most clubs, “helped by another benign year in terms of pool claims.”

AM Best said that most clubs are expected “to report significant investment returns in 2023/24, leading to a partial recovery in free reserves.”

“[T]he large majority of the clubs will report significant investment income in 2023/24 as prior year unrealized losses unwind,” the report said. “Going forward, investment income is expected to contribute more to the clubs’ bottom lines as a result of a higher interest-rate environment, which allows clubs to obtain better yields on their fixed income portfolios.”

That is a marked improvement from 2022/23 when investment returns were negative for the International Group, which drove the group’s combined result to a loss before tax of US$360 million.

Trends Affecting P&I Claims

Following five years of very high pool claims from 2017/18 to 2021/22, the International Group clubs experienced a sudden reduction in 2022/23. AM Best said there are competing factors that are pushing up claims and others are reducing them. Here are factors that are pushing up claims costs:

- High levels of inflation

- The increasing size of vesselts, which adds complexity when severe incidents occur

- An upward trend in shipowners’ liability limits

- Technological advances that allow deep-water wreck removal.

Here are the factors that have had a positive impact on claims costs:

- The fall in the age of vessels

- Technological advances in navigation

- Investment in loss prevention

- Increases in club deductibles.

Effects of International Group Consolidation

The North of England Protecting and Indemnity Association (North P&I Club) and The Standard Club merged in February 2023, creating the NorthStandard club, the second largest P&I club after Gard.

“This merger could open the way for other clubs to follow with similar transactions. In a period when P&I clubs have struggled with significant technical and investment losses and free reserves have deteriorated, most clubs would likely benefit from a larger scale,” which AM Best said would likely “lead to increased diversification and lower volatility in loss ratios, while reducing operating expense ratios.”

Further, larger clubs might be able to obtain better terms in their individual reinsurance programs, the report added. “On the other hand, this consolidation process could negatively affect shipowners, as a reduction in the number of clubs would translate into less competition between clubs and, therefore, less bargaining power for shipowners.”

Source: AM Best

Was this article valuable?

Here are more articles you may enjoy.

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts