Hurricane season has arrived. Although we’re still ahead of the historical September peak, PCS has already recorded two tropical events making landfall in the United States and notes outside forecasts of another busy year. Further, hot and dry conditions in western states bring back memories of the 2020 wildfires affecting California, Oregon, Washington, and Colorado and should help re/insurers remain vigilant in the coming months. Severe convective events have been frequent and significant in 2021. Quite simply, there has been no shortage of catastrophe activity in 2021. The first half of the year is tied with 2019 as being the busiest first half in the past 20 years, with 30 PCS-designated events. It seems as though the rest of the year could be active, as well.

And COVID-19 remains a potential issue for catastrophe response.

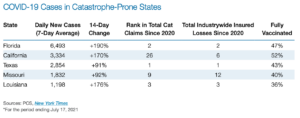

Much has changed in the past year. Beyond increased familiarization with living and operating in a pandemic environment, vaccines, social distancing measures, and other emergency response efforts have helped affect at least a partial return to normal. Meanwhile, several indicators suggest continued pandemic risk. In the United States, average daily cases reached 30,702 (based on a seven-day average) on July 17, 2021, according to data from the New York Times, representing an increase of 126 percent over 14 days. And a handful of states appear to have driven most of the increases. They are also among the most prone to catastrophes in the country, which could have implications for re/insurers covering U.S. risks.

PCS evaluated the states with the greatest recent increases in average daily COVID-19 cases alongside their historical catastrophe activity. Three of the five states with the largest surges in average daily cases are also the top three for both aggregate catastrophe claims and total industrywide insured losses attributable to catastrophe events since 2000. Texas, Florida, and Louisiana are generally exposed to both tropical storms and severe convective events. Missouri is among the top ten states according to PCS for aggregate catastrophe claims since 2000, and it’s twelfth for total industrywide insured losses. California may not rank as high in terms of total catastrophe claims, but wildfire activity since 2017 has led to a significant increase in the state’s rank in total industrywide insured losses as measured over the past 20 years.

A major catastrophe impacting Florida, California, Texas, Missouri, or Louisiana could be complicated by measures instituted or social behaviors changed as a result of COVID-19. Social distancing, reluctance by claimants to allow adjusters inside to inspect (or vice versa), and supply chain impediments caused by the pandemic could result in longer claim lifecycles and increased expenses. And in areas more affected by the pandemic, municipal offices could experience reduced workforces, which in turn could cause delays in granting permits for rebuilding and building inspections. Low rates of vaccination in these states (with California the only one over 50 percent) suggest that the risk of increased COVID-19 transmission in states at high risk of catastrophe activity could continue throughout hurricane season. This also means that there’s a risk of post-catastrophe remediation having the potential to further spread COVID-19 compared to states with higher rates of vaccination. An adjuster visiting several claimants a day, construction teams interacting with homeowners, and (in the worst case) evacuation centers all have the potential to facilitate broad transmission.

As COVID-19 cases tick higher and the rate of transmission appears to be accelerating, re/insurers should keep an eye on rates of infection in catastrophe-prone states, particularly as hurricane season’s peak approaches. To prepare for catastrophe response activities which are made more difficult by COVID-19, insurers and independent adjusters can:

- Review and test capabilities for remote adjusting: This can include revisiting thresholds for fast-tracking claims, evaluating drone and other aerial imagery usage, and implementing (or at least piloting) tools like ClaimXperience, which can reduce the need for on-site inspections of residential and some small commercial claims.

- Take a look at personal protective equipment (PPE) access: In addition to ensuring that insurers and independent adjusters have sufficient PPE resources on hand, it may make sense to think through what a major catastrophe event (such as a Gulf of Mexico hurricane) could mean for the availability of additional PPE. If an event could

result in a shortage, even if only temporarily, having more PPE stored could result in reduced cycle time if a major catastrophe occurs. - Strategic use of resources: The past five years have presented significant challenges to re/insurers from a field resource standpoint – particularly for claims that require an adjuster’s physical presence to inspect and assess damages. Triple hurricane events in 2017 (Harvey, Irma, and Maria), two more in 2018 (Hurricanes Michael and Florence), and major wildfire events every year since 2016 (with 16 of them in the third quarter of 2020) have led to a steady increase in the number of residential and commercial losses requiring physical inspection due to total and near-total loss. There’s a finite amount of field adjusters, and companies will need to engage them judiciously to be able to meet the needs of their insureds should the trend of major events occurring in close succession continue.

- Talk to each other: Catastrophe response preparation benefits from communication almost as much as it does anything else. Insurers and independent adjusters should share their ideas, concerns about post-event COVID-19 challenges, and steps being taken to prepare for a more complicated claim-handling environment.

Increased COVID-19 transmission and slower progress on vaccination could cause claims to become more expensive and cycle times to increase. And the operational challenges associated with working in an environment with elevated virus risk can be significant. The fact that there’s an overlap between the states most prone to catastrophes and those with increased transmission (and lower vaccination rates) should remind re/insurers of the need to remain vigilant.

Was this article valuable?

Here are more articles you may enjoy.

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot