The U.S. property/casualty insurance industry recorded a slight underwriting improvement in 2023, but losses persisted, according to a new AM Best report.

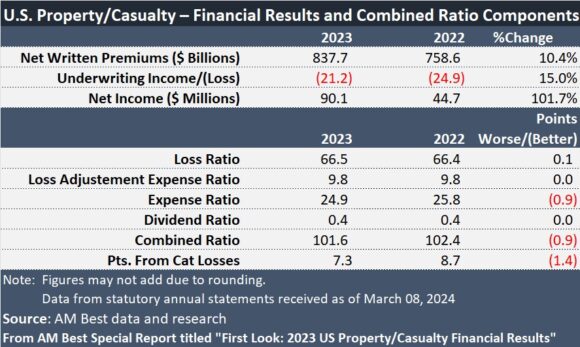

Preliminary data from the global credit rating agency shows that the industry posted a $21.2 billion net underwriting loss last year. That was down from the $24.9 billion underwriting loss recorded in 2022.

AM Best’s figures are derived from annual statutory statements received as of March 8, 2024, and represent an estimated 97% of the total P/C industry’s net premiums written. The numbers show that the P/C industry’s combined ratio improved by 0.9 percentage points to 101.6 in 2023, according to the AM Best’s Special Report, “First Look: 2023 U.S. Property/Casualty Financial Results.”

“Catastrophe losses accounted for an estimated 8.7 points on the combined ratio, up from 7.3 points in 2022, driven by record severe convective storm losses,” AM Best said. “The underwriting loss came despite a 9.9% growth in net earned premiums, as this was countered by a 10% increase in incurred losses and loss adjustment expenses, a 6.4% rise in other underwriting expenses and a 4.5% increase in policyholder dividends.”

Net written premiums jumped 10.4% to $837.7 billion in 2023.

Related: Hail, Convective Storms, Population Now Driving Billions in Losses

AM Best reported that with net investment income “virtually unchanged” from the prior year, the lower 2023 underwriting loss “boosted pre-tax operating income by 4.8% to $50 billion. A $51.1 billion change in net realized capital gains at National Indemnity Company resulted in net income for the industry more than doubling to $90.1 billion.”

In a report published earlier this month, AM Best wrote that the U.S. P/C industry’s underwriting loss for 2023 reached a 10-year high of $38 billion, with a corresponding combined ratio of 103.7. According to an AM Best spokesperson, the data in the earlier report included third-quarter results and a fourth-quarter estimate based on historical data. The data in the new report is based on year-end filings to date.

The spokesperson said that the gap (from a P/C underwriting loss of $38 billion in earlier reporting to a loss of $21.2 billion now) might be explained by reserves. Analysts think it is possible that either a majority of P/C companies—or enough of the largest companies—decided they were overly conservative with reserves for prior accident year losses, and may have made significant enough adjustments to these reserves so the year-end total was decreased to a loss of $21.2 billion.

(Editor’s Note: The newest report also included results of the mortgage and financial guaranty insurance. The estimates in the earlier report from AM Best exclude these lines.)

Was this article valuable?

Here are more articles you may enjoy.

US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts  Berkshire Utility Presses Wildfire Appeal With Billions at Stake

Berkshire Utility Presses Wildfire Appeal With Billions at Stake