S&P Global Market Intelligence weighed in on the U.S. cyber insurance marketplace, reporting that premium dipped in 2023 to end several years of rapid growth.

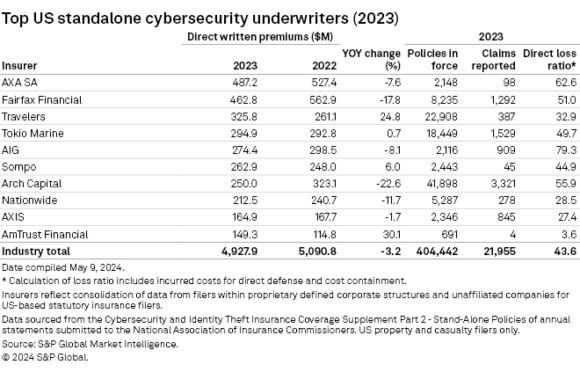

The overall 0.7% decline in cyber insurance direct written premiums was driven by a 3.2% drop in standalone business to about $4.9 billion. Package cyber grew by 5.1%, S&P said in a new report.

The insight coincides with one published recently by Fitch Ratings. It too reported an unexpected slight drop in direct premiums in cyber for 2023.

Related: Report Shows Cyberattacks Over Work Email Most Used; Ransomware Hits Victims Hard

After rising during 2020-2022, the price of cyber insurance started dropping in the second half of 2023. The trend has continued in 2024 with prices falling 6% overall in the first quarter, though a look at the 2023 data of individual companies reveals mixed results. For instance, AmTrust Financial and Travelers grew cyber direct premiums by about 30% and 25%, respectively.

“Some underwriters are concerned the price cuts are premature because they are being made without evidence of a sustained reduction in claims, although they say pricing remains adequate for the risks being taken on,” said S&P. Loss ratios, for now, remain relatively stable.

“Some underwriters are concerned the price cuts are premature because they are being made without evidence of a sustained reduction in claims, although they say pricing remains adequate for the risks being taken on,” said S&P. Loss ratios, for now, remain relatively stable.

Recent cyber news, especially the ransomware attacks in the healthcare industry, have highlighted the aggregation exposure insurers face for outages and data exfiltration. Attacks on healthcare entities are not the only worry. Citing CyberCube, S&P said more cyberattacks may happen during this election year—or in response to other global geopolitical tensions.

Was this article valuable?

Here are more articles you may enjoy.

These Five Technologies Increase The Risk of Cyber Claims

These Five Technologies Increase The Risk of Cyber Claims  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot