Even the smartest institutions in the land can miss deadlines – and can lose $15 million in insurance coverage because of it, a federal appeals court decided Wednesday.

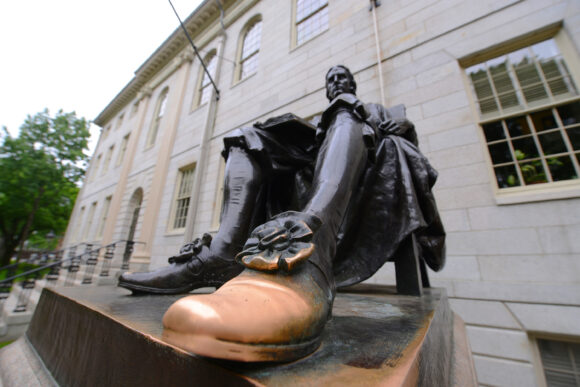

The U.S. 1st Circuit Court of Appeals upheld a lower court ruling that found that a Zurich American Insurance Co. subsidiary does not owe coverage to Harvard University in its long-running and high-profile affirmative action litigation. The reason? Harvard did not provide notice to its insurer within 90 days of the end of the policy period, as required by the policy.

“Zurich had every right to deny coverage based on lack of timely notice,” Circuit Judge Bruce Selya wrote for the panel of judges. Harvard’s arguments in its appeal “lacked force” and were “little more than gaslighting,” the opinion said.

Harvard in 2014 had purchased a one-year, $25 million liability policy from AIG unit National Union Fire Insurance, which covered litigation costs for claims brought against the university. The institution also obtained a $15 million excess policy from Zurich American, to cover legal costs after the AIG policy was exhausted.

Both policies were claims-based, not occurrence-based, and both required Harvard to report legal claims no later than 90 days after the end of the policy period. The policies covered Nov. 1, 2014 to Nov. 1, 2015.

The now-monumental lawsuit that successfully challenged Harvard’s admissions policy, which culminated with a landmark ruling by the U.S. Supreme Court in June, was filed Nov. 17, 2014. Harvard notified AIG but failed to notify Zurich until May 2017, well after the 90 day notification window, the appeals court explained.

Zurich denied the coverage and Harvard sued. A federal district court in November 2022 decided against the school, and Harvard appealed.

The university’s attorneys argued that although Harvard did not provide formal notice of the suit, Zurich probably knew about it through news reports. The university asked for discovery to show what Zurich officials may have known about the case at the time. But the district court and the appellate judges ruled against that motion, noting that such information was irrelevant because the policy required written notice.

Harvard also argued that Massachusetts law gives insureds some leeway on late notices, as long as late notice does not prejudice the insurer’s claim investigation. But the appeals court said that deadlines are even more important in claims-based policies, so that insurers can accurately set premiums.

A claims-made policy covers claims made during the policy period, regardless of when the incident or act occurred, the court explained. The purpose is to minimize the time between the insured event and the payment. If a claim is made against an insured, but the insurer does not know about it until years later, the primary purpose of insuring claims rather than occurrences is frustrated, the court noted, citing a 1989 Massachusetts Supreme Judicial Court decision, Charles T. Main vs. Firemen’s Fund Insurance.

“Not all liability insurance policies are on an equal footing, and the ‘no harm, no foul’ principle does not apply to failures to give timely written notice under claims-made insurance policies,” said the 1st Circuit’s opinion in the Harvard case. “In Massachusetts, notice provisions of claims-made policies — which require that notice of a claim be given by the end of the policy period or a defined period ending shortly thereafter — are of the essence of those policies. Those provisions are intended not merely to facilitate an investigation into the facts underlying a claim but also — just as importantly — to promote fairness in rate setting.”

In a landmark decision, the Supreme Court, by a 6-3 vote, in June struck down the use of race as a factor in deciding which students are granted admission to college. The case, Students for Fair Admissions vs. Harvard, essentially ended the affirmative action program and already had a widespread impact on college admissions.

Harvard may have little trouble paying its legal costs, some have suggested. The university’s endowment from donors stood at $53 billion in 2021, the largest in the country, according to U.S. News & World Report. Zurich American Insurance Group, on the other hand, also is well capitalized, with a $6.5 billion profit in 2022, the group has reported.

Was this article valuable?

Here are more articles you may enjoy.

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand