Tornadoes and thunderstorms in the South and Midwest made the 2011 second quarter tumultuous for U.S. property writers.

The industry loss ratio, before consideration of reinsurance, climbed to 70.6 percent, marking the industry’s second worst performance since 2001 and far outpacing the loss ratios of 58.1 percent and 56.2 percent for the 2010 and 2009 second quarters, respectively, according to SNL Insurance, a division of SNL. The industry premium remained essentially flat, decreasing just 0.2 percent from the 2010 second quarter.

Auto insurance companies also took a big hit thanks to major catastrophes.

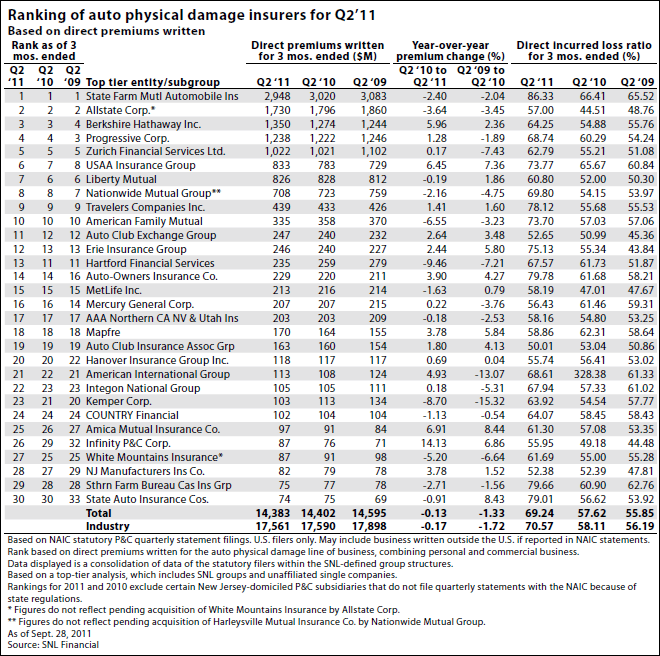

State Farm Mutual Automobile Insurance Co., the largest U.S. auto writer, took a major blow to its profitability in the quarter.

State Farm experienced a direct loss ratio of 86.3 percent for auto physical damage, approximately 2,000 basis points higher than the loss ratios reported for the previous two second quarters. State Farm writes almost a quarter of all auto physical damage premium in the tornado-affected states of Alabama, Mississippi, Missouri and Oklahoma, more than the next three largest writers combined.

The rest of the top five overall writers — Allstate Corp., Berkshire Hathaway Inc. — including GEICO Corp., Progressive Corp. and Zurich Financial Services Ltd. — including 21st Century and Farmers Group Inc. — all saw their loss ratios increase compared to the second quarter of 2010, though these increases were smaller than that experienced by State Farm.

Travelers Cos. Inc., Erie Indemnity Co., Southern Farm Bureau Casualty Insurance Group and State Auto Financial Corp. also saw sizable hits to their loss ratios.

Southern Farm Bureau is a regional insurer that wrote 26 percent of its private auto business in Mississippi in 2010, producing considerable exposure to the April 27 tornadoes in Smithville and Greensburg, Miss., as well as other damaging storms in the Southeastern U.S.

Not all of the top auto carriers were exposed to the tornadoes. Mercury General Corp., Fundacion MAPFRE, Auto Club Insurance Association Group, Hanover Insurance Group Inc. and New Jersey Manufacturers Insurance Co. are all regional writers whose auto business experienced minimal or no impact from the tornadoes that affected most of the industry.

However, while Hanover experienced only a 55.8 percent loss ratio for its auto physical damage business for the quarter, according to SNL, the homeowners report shows a statutory loss ratio of 99.5 percent for the company. Hanover disclosed in its second-quarter Form 10-Q a GAAP loss ratio for homeowners of 105.6 percent, including catastrophe losses representing 58.8 percent of premium for the quarter.

Was this article valuable?

Here are more articles you may enjoy.

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Berkshire Utility Presses Wildfire Appeal With Billions at Stake

Berkshire Utility Presses Wildfire Appeal With Billions at Stake