Erroneous policy information from customers and agents, whether by accident or intent, can distort actual risk and take a heavy toll on auto insurers’ underwriting results. Research conducted by Verisk Analytics for three large insurers found deteriorating application integrity contributed significantly to the companies’ worsening loss ratios.

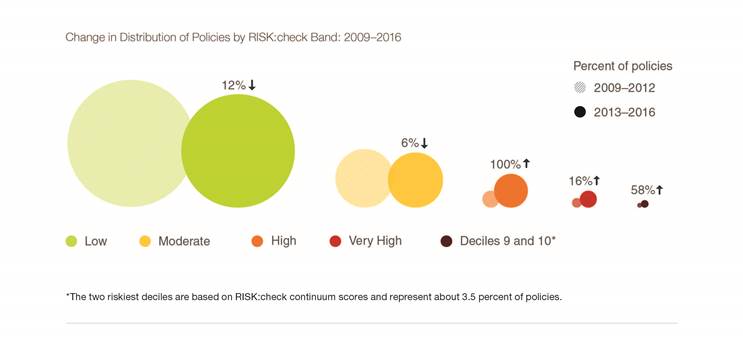

This unexpected result revealed another dimension to the troubles of the personal auto market beyond the widely recognized rises in frequency and severity of claims. A comparison of statistics from 2009 to 2012 with results from 2013 to 2016 showed substantial erosion of the overall quality of applications as measured by Verisk’s RISK:check model. Policies in the two highest risk deciles (9 and 10) increased their share of the total by 58 percent, and their adjusted loss ratio was 81 points higher than the mean for the business sampled.

This unexpected result revealed another dimension to the troubles of the personal auto market beyond the widely recognized rises in frequency and severity of claims. A comparison of statistics from 2009 to 2012 with results from 2013 to 2016 showed substantial erosion of the overall quality of applications as measured by Verisk’s RISK:check model. Policies in the two highest risk deciles (9 and 10) increased their share of the total by 58 percent, and their adjusted loss ratio was 81 points higher than the mean for the business sampled.

Overall application integrity (as measured by the average RISK:check continuum score) eroded by more than 15 percent in key areas. Among the nine factors identified that could explain the growing incidence of missing or invalid entries on applications are the following:

- Consumers may be unable to accurately complete some fields, such as mileage.

- Soft market conditions may breed greater tolerance for application gaps.

- Incomplete or unverified third-party prefill data may introduce errors.

- Deliberate misrepresentation or fraud.

- Agent manipulation to lower rates in order to gain new business.

The findings are explored in Application Integrity: The Whole Truth, a new Verisk Insurance Solutions Innovation Paper based on time-series analysis of more than 3 million policies from 2009 to 2016. Verisk’s quality-of-book analysis on the three insurers produced some notable statistics; for example, invalid or blank driver’s license information was found in 12.1 percent of policies.

The authors suggest auto insurers should consider screen technology and/or predictive analytics to answer several questions, such as:

- Is the applicant who he or she claims to be?

- Who has insurable interest?

- How is the vehicle being used?

- What is the risk profile?

Read the white paper: http://www.verisk.com/underwriting/auto/application-integrity-whole-truth.html

Source: Verisk Analytics

Was this article valuable?

Here are more articles you may enjoy.

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand  Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads