Insurers that earn jeers from their customers are falling further behind the ones that earn cheers.

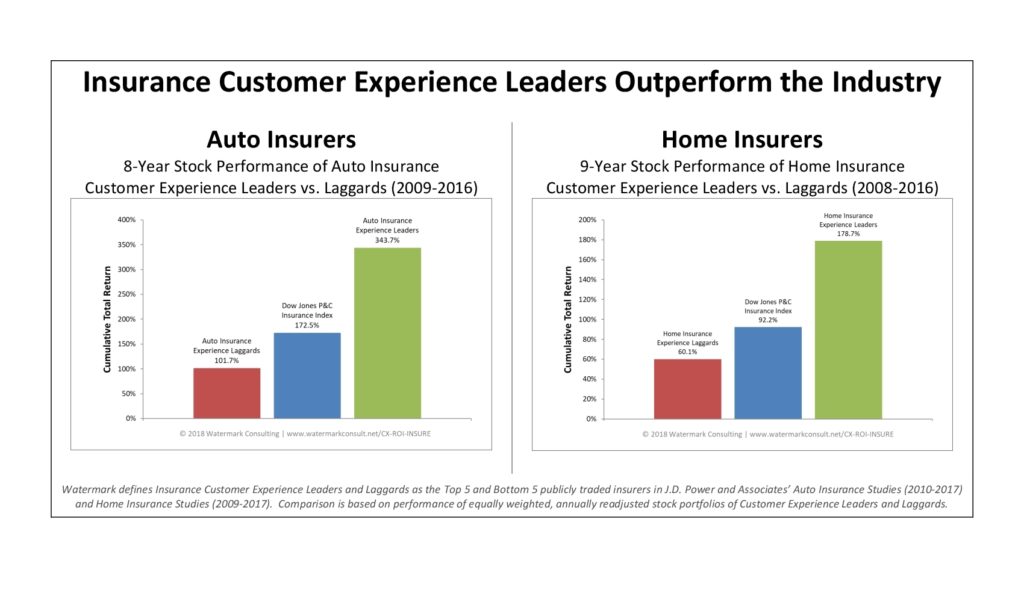

Watermark’s Insurance Customer Experience ROI Study focused on model portfolios of the Top 5 Leaders and Bottom 5 Laggards publicly traded insurers in J.D. Power and Associates’ annual Insurance Satisfaction Studies.

“The headline here is simple: Insurers that lead in customer experience are rewarded handsomely by consumers and investors alike,” explained Jon Picoult, Founder and Principal of Watermark Consulting.

With nearly a decade of data examined, the study found that a portfolio of property/casualty insurers which excelled in customer satisfaction far outperformed the industry index (which, in turn, outperformed insurers with the weakest satisfaction). The Leaders generated average annual returns which were more than double that of the Laggards.

“What was most striking was that the margin of outperformance between the Leaders and Laggards has widened considerably over the past couple years,” said Picoult. “The competitive edge enjoyed by Insurance Customer Experience Leaders is not just real, it is strengthening.”

The results suggest insurers should consider investing more in their customer experience. “This is an industry that is far more enamored with acquiring new customers than it is with delighting the ones they already have,” Picoult commented.

Carriers that impress policyholders reap tangible rewards in the form of increased loyalty, greater wallet share, stronger word-of-mouth and a more competitive cost structure – all of which makes them more appealing and valuable in the eyes of the market.

A white paper describing the study, and the secrets behind the Leaders’ dominance, is available here.

Source: Watermark Consulting

Was this article valuable?

Here are more articles you may enjoy.

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says