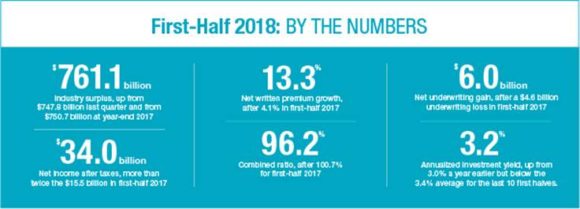

Private U.S. property/casualty insurers saw their net income after taxes more than double to $34 billion in first-half 2018 from $15.5 billion in first-half 2017, with the help of lower catastrophe losses, growing premiums, and an increase in investment income, according to ISO, a Verisk business, and the Property Casualty Insurers Association of America (PCI).

Losses and loss adjustment expenses from catastrophes declined to $14.6 billion for first-half 2018 from $18 billion a year earlier. Net written premiums grew 13.3 percent in first-half 2018 from 4.1 percent a year earlier, affected in part by the growth in the economy, rising auto premiums, and changes that multiple insurers made to their reinsurance arrangements. Overall, insurers enjoyed a $6 billion net underwriting gain, rebounding from a $4.6 billion net underwriting loss for first-half 2017.

Net investment income jumped 14.6 percent to $26.8 billion from $23.4 billion, with the increase mostly due to large dividends from insurers’ subsidiaries that don’t operate in property/casualty insurance.

Second-Quarter Results

Insurers’ net income after taxes rose to $16.9 billion in second-quarter 2018 from $7.5 billion in second-quarter 2017, and their combined ratio improved to 97.7 percent in second-quarter 2018 from 101.9 percent a year earlier.

Insurers’ net income after taxes rose to $16.9 billion in second-quarter 2018 from $7.5 billion in second-quarter 2017, and their combined ratio improved to 97.7 percent in second-quarter 2018 from 101.9 percent a year earlier.

Their annualized rate of return on average surplus more than doubled to 9 percent in second-quarter 2018 from 4.2 percent a year earlier.

Net written premiums rose 10.9 percent in second-quarter 2018, compared with 4.2 percent in second-quarter 2017.

View the full report from ISO and PCI here.

Source: ISO/PCI

Was this article valuable?

Here are more articles you may enjoy.

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions