A consumer survey found that claims handlers for U.S. auto insurers have the highest customer satisfaction levels ever recorded, J.D. Power said Thursday.

The market research firm, based in Costa Mesa, Calif., said the average overall customer satisfaction score of 868 out of a possible 1,000 points is up seven points from the 2018 survey. Every factor measured — first notice of loss, claim servicing, estimation process, repair process, rental experience and settlement — showed improvement.

“The investments made by insurers in claim digitization and internal process improvements are resulting in shorter cycle times and an improved overall claim experience,” stated David Pieffer, vice president of property and casualty insurance intelligence for J.D. Power. “Despite this strong performance, there is still some room for improvement, particularly in the area of helping claimants feel more at ease during the first notice of loss.”

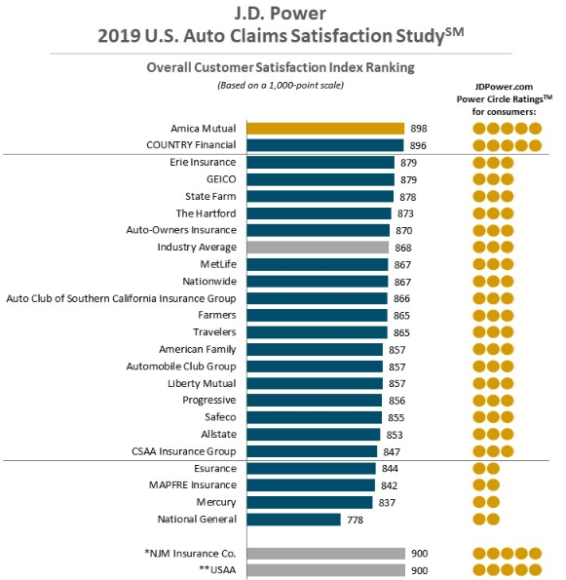

Amica Mutual, with 898 points, ranked the highest of 23 property and casualty insurers included in the J.D. Power ranking. Country Financial, with 896 points; Erie Insurance, 879; GEICO, 879; and State Farm, 878, filled out the top five. J.D. Power noted that GEICO and State Farm both showed significant improvement since last year’s customer satisfaction survey. GEICO was up 22 points and State Farm was up 14, according to an executive summary.

Two well-known carriers scored even higher than Amica with 900 points each, but were not included in the survey because their membership is restricted. NJM Insurance Co. is sold only to certain public employees and trade association members in New Jersey, while USAA is sold only to members of the U.S. military and their families.

National General came in on the bottom of this year’s satisfaction scale, with 778 points. Mercury Insurance, with 837; MAPFRE Insurance, 842; Esurance, 844; and CSAA Insurance Group were also in the bottom five.

The survey highlighted one area where auto insurance policyholders have reason to be happy: The amount of time that passes from the first notice of loss to the return of the vehicle to the customer has been cut to an average of 12.9 days in 2019, down from 13.5 days in the year prior.

By comparison, a J.D. Power survey taken in late 2011 found the repair cycle time was 15.8 days, according to a press release issued at the time. That increased to 13.4 days in 2014.

Insurers may be less satisfied with another indicator. J.D. Power said only 64% of customers said they felt ease during the first notice of loss. “Younger claimants are significantly less likely than their older counterparts to say they are at ease after initially reporting their claim,” J.D. Power said.

The research firm said three “levers” that have a notable influence in making customers feel at ease: Clearly outline the next steps, explain the claims process and explain the coverage. Helping claimants feel at ease is the single performance indicator with the largest overall effect on customer satisfaction and brand advocacy, J.D. Power said.

The 2019 U.S. Auto Claims Satisfaction Study is based on responses from 11,186 auto insurance customers who settled a claim within the past six months prior to taking the survey. The study excludes claimants whose vehicle incurred only glass/windshield damage or was stolen, or who only filed a roadside assistance claim. Survey data was collected from November 2018 through September 2019.

Was this article valuable?

Here are more articles you may enjoy.

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says