Insurers are making a bundle on personal auto because claims have plummeted, but the long-term outlook for the line isn’t so rosy, analysts say.

Fitch Ratings last week reported that the short-term performance for auto insurers is “unsustainable, and we expect profit challenges in the future as regulatory and competitive pressures hinder any rate increases when losses return to historical norms.” A report by Deloitte also predicts declining premiums, but made no projections about profit margins.

Fitch was pessimistic enough to revise its fundamental sector outlook for the personal auto line to negative. Fitch said it expects a decline in investment and operating performance as claims frequency returns to more normal levels.

At the same time, Fitch affirmed the stable rating for the property and casualty and reinsurance sector, “given the capital strength for the vast majority of insurers to withstand the pandemic fallout.”

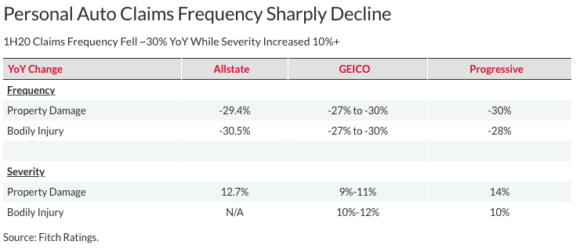

Fitch said U.S. insurers have given $12 billion in rebates to policyholders this year and that number continues to grow. But declining claim numbers are producing far more in savings. Personal auto claim frequency during the first quarter of 2020 dropped by 27 percent to 30 percent for Allstate, GEICO and Progressive, while claim severity increased by 9 percent to 14 percent.

Fitch said the average combined ratio for eight personal auto carriers that report financial results using Generally Accepted Accounting Principles was a “highly profitable” 85.5 percent during the first quarter, compared to 92 percent in the first quarter of 2019.

On the other hand, driving activity is increasing and claim frequency will eventually more toward traditional levels, while “loss severity moves perennially upward for auto insurance,” Fitch said.

At the same time, auto insurance rates are dropping. “Underwriters’ regulatory rate filings widely portend further premium reductions in the near term, which will lead to further industry auto revenue declines,” the ratings house said.

James B. Auden, managing director for Fitch Ratings in Chicago, said insurers are using premium rebates and rate reductions as a competitive tool.

“When claims costs revert to normal, it may be harder to respond to get back to rate adequacy,” Auden told the Claims Journal. “If you’re in a regulated state, your regulator may say, “you had this level of profits six months ago, why are you asking for a rate increase now?”

On top of rising claims numbers, insurers are also grappling with a continuing pandemic that makes it difficult to predict investment returns, he said.

“Social uncertainty leads to the potential for adverse effects on the insurance industry,” Auden said.

If Fitch is right, a decline in profits would reverse a two-year long trend of improving returns for the personal auto line.

In a report released July 23, A.M. Best noted that in 2018 and 2019 the personal auto line has the best returns in a decade. From 2010 to 2017 the combined ratio for the industry never dropped below 101 percent, said A.M. Best Associate Director David Blades in a webcast outline.

Deloitte, the global financial services firm, said in a report released Aug. 14 that auto carriers should expect to see “a steady decline in premiums written for the next several quarters, and perhaps even for years.”

Deloitte said premiums may recover when driving returns to normal levels.

“If, on the other hand, insurers offer premium discounts going forward on new and renewal policies due to more systemic changes in driving patterns, that could have a longer-term impact on personal auto premium volume,” Deloitte said. “Indeed, our actuarial team anticipates single-digit rate decreases for the next several quarters, which would keep personal auto premiums well below pre-pandemic levels until 2023.”

Was this article valuable?

Here are more articles you may enjoy.

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts  Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings