Moody’s Investor Service said Wednesday that wildfires in the U.S. West have caused $5 billion to $8 billion in insured losses so far — an amount that would make it the third-worst year for fire damage in U.S. history.

The wildfire tab comes on top of $20 billion in insured losses from other catastrophes in North America during the first half of this year, according to a separate report from Munich Re. In the meantime, wildfires are still raging throughout the west, while back east Hurricane Sally is dropping what the National Weather Service calls “historic rainfall” in Florida and Alabama.

Moody’s pegged insured losses from wildfires at $4.8 billion in California alone. That is based on an estimate by California fire officials that 5,792 structures have been damaged or destroyed, each one with an average value of $826,000.

“However, there is considerable variability around this estimate because of the wide range of values for homes and commercial structures in the affected areas,” the ratings house said.

Moody’s said an additional 3,865 structures have been destroyed in Oregon, Washington and other western states this year. Construction costs and home values are lower outside of California. Moody’s said overall, wildfire damages likely amount to $5 billion to $8 billion throughout the West.

“Given the strong recent recovery in the housing construction market following the coronavirus shutdown in second-quarter 2020, the increase in demand for construction labor and materials following the wildfires and other recent catastrophes has the potential to lead to higher insured losses,” Moody’s said.

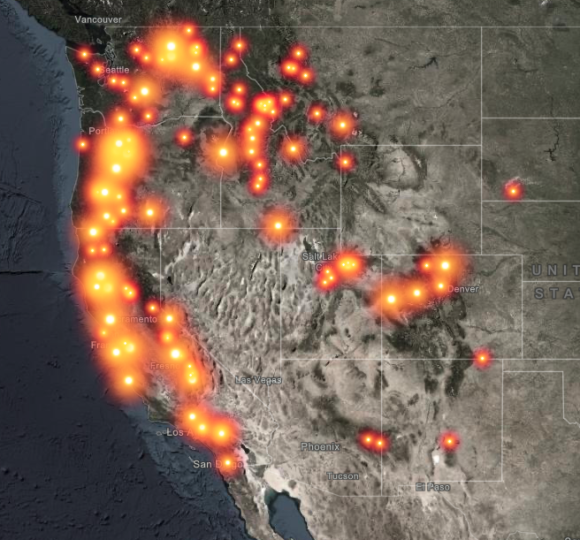

Data provided through a live feed built by Ersi, a data analytics provider, shows that wildfires continued to rage in California, Oregon, Washington, Idaho, Utah, Colorado, Nevada and Arizona late Wednesday. The Riverside fire in the Cascade Range east of Salem, Oregon, for example, was only 3% contained after burning 137,409 acres. In California, the Creek Fire east of Fresno was 18% contained after burning through 220,025 acres. In Colorado, the Cameron Peak fire north of Denver was 8% contained after burning 102,596 acres.

Moody’s estimate of insured losses surpasses a projection by CFRA Research that wildfires had caused $3 billion in insured losses as of Aug. 31. CFRA Analyst Cathy Seifert said she has not updated her estimate since then, but her best guess is that wildfire losses have reached $5 billion by now.

“If anybody tells you they they have a high degree of certainly don’t believe them,” she said.

Seifert said in addition to structural damage, the wildfires are producing so much smoke that some businesses are unable to operate. She said insurers should expect a good number of business-interruption claims to be generated by the wildfire.

Seifert said the wildfires combined with other natural disasters that have struck the U.S. this year may exacerbate losses to insurers by driving construction cost inflation. She said that is one of many variables that make it difficult to project total catastrophe losses.

Munich Re chronicled the series of disasters that have struck North America during the first half of the year in a report released last month.

Severe thunderstorms generated flash floods, tornadoes and hail that caused $20 billion in insured losses, the reinsurer said. And those losses were tallied before Hurricane Isaias pummeled the Northeast with a wide-swath of gale-force winds, Hurricane Hanna hit Padre Island, Texas and Hurricane Laura struck the southwestern Louisiana coast.

Analysts projected that Laura caused $9 billion in insured losses. Damages from Isaias was estimated at $4 billion and Hanna caused an estimated $350 million in damage.

If wildfire losses have reached $8 billion so far, as Moody’s predicts, 2020 promises to be an epic year for wildfire losses much like 2017 and 2018.

According to Insurance Information Institute data, insured losses from wildfires totaled a record $18 billion in 2018, breaking the $16 billion record set the year before. In the decades before then, wildfire losses never exceeded $3 billion in total, III says.

Moody’s said insurers have responded by raising rates and refusing to renew policies in regions with high fire risk.

“We expect that Oregon and Washington homeowners insurers will start taking similar actions following 2020 wildfire losses,” the report says.

About the photo: This image, a screenshot taken from Ersi’s geographic information system, shows the relative intensity of wildfires that were burning in the Western United States on Wednesday afternoon.

Was this article valuable?

Here are more articles you may enjoy.

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud