Hippo Announces Claims Team

Hippo, a digital-first home insurer that this month took its first step toward becoming a publicly-traded company, revealed Tuesday the two vendors that will act together as part of its in-house claims team.

Claimatic will take the front desk. Five Sigma’s got the back end.

Hippo said in a press release that Claimatic’s software will pair claimants with adjusters and service providers to eliminate claim reassignment issues. Five Sigma’s machine-learning software will identify the severity of claims early on and update reserves as needed, the company said.

Claimatic, based in San Antonio, Texas, grew out of a small regional independent adjusting firm purchased by Larry Cochran in 2006. The company rents its claims processing software to insurers.

Hippo said the company simplifies the process of assigning claims to adjusters and other involved parties. Claimatic automatically routed an “unprecedented number” of claims resulting from February’s deep freeze in Texas, the release said.

Five Sigma is headquartered in Indianapolis, Ind., but its leaders are based in both Israel and the United States. The company says it offers a cloud-native claims management system.

Hippo said Five Sigma will set clear reserving suggestions and consistently report on reserves over time, reducing friction in back-end claims-handling processes and speeding claims payments.

Hippo Enterprises announced on March 4 that it has reached an agreement to merge with Reinvent Technology Partners Z to become a special-purchase acquisition company. Known as blank-check companies, SPAC stocks are sold to the public at values that are based on projected sales.

Hippo, headquartered in Palo Alto, Calif., was founded in 2015 as a managing general agent and is now a stock insurer that sells in 33 states.

New Ownership, Continued Expansion for Davies

BC Partners, a London-based investment house, announced that it has purchased a majority stake in Davies, a claims management provider that has been expanding its operations in North America.

Terms of the transaction were not disclosed.

BC Partner said in a press release that its ownership interest will diversify and strengthen Davies shareholder base as the company continues to pursue mergers and acquisitions with complementary businesses.

“We at BC have been watching Davies’ progression over the past few years with keen interest, as this was a business we knew had serious potential,” stated partner Cédric Dubourdieu.

Earlier this month, Davies announced that it had acquired The Littleton Group in Austin, Texas.

Davies said all 165 employees of the independent claims manager and third party administrator will remain in place. Chief Executive Officer Steve Streetman will join Davies in an advisory and consulting role. Chief Operating Officer Jeff Bode will continue to lead the day to day operations.

Davies employs 4,250 in the UK, US, Ireland, Bermuda and Canada.

Arturo Using ‘Microballoons’ for Imagery

Arturo is reaching into the stratosphere to more frequently update imagery that it combines with analytics to inform insurers about the properties they are underwriting or pricing.

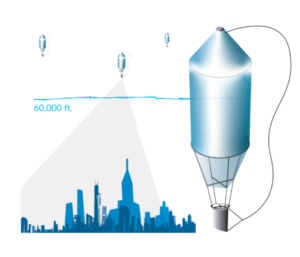

Arturo said it has contracted with Urban Sky to provide images using “microballoon” technology. Images are taken from balloons that fly at an altitude of 60,000 feet, which is above the reach of most aircraft but far closer than satellites in orbit.

Arturo said the arrangement will make it affordable to more frequently update its collection of images.

“More frequent images, in turn, makes the analytics generated by Arturo’s AI more timely and accurate, providing greater value to insurance providers who have to understand the physical condition of properties they are underwriting, pricing, etc.,” the Chicago-based insurtech said in a press release.

Urban Sky, headquartered in Denver, says on its website that it offers aerial imagery at far better resolution than commercial satellites at far less cost than images taken from airplanes.

Arturo is an insurtech developed by American Family Insurance Co.

Was this article valuable?

Here are more articles you may enjoy.

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says