Insurers and consumer advocates are conveying conflicting messages as both try to focus public attention on smoke damage claims.

Mercury Insurance issued a press release Friday warning that an unidentified California public adjuster has been duping homeowners into submitting fraudulent smoke and ash damage claims by promising to recover “thousands of dollars.”

That announcement follows a report released last week by Consumer Watchdog that accused some insurers of using “illegal coverage limitations” to deny claims for smoke damage caused by wildfires. State Insurance Commissioner Ricardo Lara held an “investigatory” hearing in Oakland to “explore solutions,” according to a report by the San Jose Mercury News.

The consumer group’s report resulted in a sympathetic story by the newspaper that opened with the experience of a homeowner who said she received a $1,100 check for $200,000 in smoke damage to her home when the CZU Lightning Complex Fires tore through the Santa Cruz Mountains.

Mercury Insurance’s press release, on the other hand, portrays greedy public adjusters that canvas door to door, passing out flyers and even advertising on banners streaming behind airplanes in order to persuade policyholders to file phony claims.

“When we checked on our insureds to see how we can help them and make sure we fulfill our promise of being there for them, many were unaware a claim was filed on their homeowner’s policy,” said Pete Galassi, Mercury Insurance special investigations unit manager, according to the press release. “Some professional entities don’t care about the harm they can do and will use trickery to take advantage of law-abiding homeowners in vulnerable situations.”

Mercury said one public adjusting firm has submitted “a large number” of fraudulent smoke and ash damage claims. Some were filed by homeowners who do not speak English and didn’t know what they were signing, the insurer said.

Mercury didn’t identify the public adjusting company that committed the misdeeds described in the press release. Company spokesman Kyle Reuter said the carrier intended the release to be taken as a public service announcement. He said the insurer cannot comment on any “legal matters.”

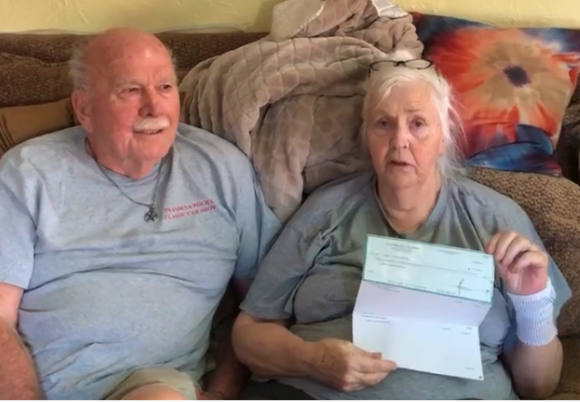

One Southern California public adjusting firm makes no secret about its efforts to drum up business. California Recovery Group posts video testimonials on its website, in which customers talk about the flyers they received from the company.

In one testimonial, an elderly woman, sitting next to a man who presumably is her husband, holds up a check. She says she waited for months before responding to a California Recovery Group flyer, but is glad she finally did.

“I thought at first it might be a scam but it’s not,” the woman says. “Now we can get our house cleaned in ways that may help our health, which has suffered ever since the fires.”

Not all customers are so happy. According to the Better Business Bureau, consumers filed six complaints about California Recovery Group in the past three years. One of the complainers said a man soliciting door to door persuaded his wife to sign a document when he stepped away to take a call. A few days later he received notice that an insurance claim had been filed. He said the company took advantage of his wife and “put him off” when he tried to terminate the claim.

The Better Business Bureau website says that California Recovery Group terminated the claim after being notified about the complaint. The other five complaints against the company were similarly resolved.

The bureau’s website shows that California Recovery Group averaged a five-star rating in customer service reviews.

And the business appears to be growing. California Recovery Group began doing business in Nevada last year after a brief kerfuffle with the state regulators, according to a report by 4 News, an NBC affiliate.

The television station reported last August that California Recovery Group had been mailing postcards to homeowners after wildfires struck the area, warning them about the damage that can be done by smoke and referring them to a website. The Nevada Division of Insurance told 4 News that the owner of the company, Argen Youseffi, cannot operate in Nevada because he was not registered with the state.

The television station updated the story a month later to report that Youseffi had registered the business in Nevada. He did not immediately return a call by the Claims Journal on Friday.

Matthew J. Smith, executive director of the Coalition Against Insurance Fraud, said in an email that both the consumer and insurer perspectives of smoke damage claims are legitimate. He said many smoke damage claims are proper, but Mercury’s experience shows that there is also potential for abuse.

“We have received multiple reports of solicitations being made by attorneys and smoke remediators trying to convince policyholders to make claims where they did not believe (or allegedly realize) they had any smoke damage claim,” he said. “Additionally, many of these result is no remediation ever being done but simply trying to receive payment by the insurer and then use the claim payment for other purposes.”

He said the coalition has offered to serve as a facilitator to bring stakeholders together to develop reasonable limits on smoke damage claims, potentially based on the amount of elapsed time from the fire occurrence and distance from the fire border.

“Our goal would be to build some consensus to equally protect consumers who have valid claims, while recognizing the need to make sure fraudsters and scammers do not raise policyholder premiums through exploitation of these types of smoke claim losses,” Smith said.

About the photo: This screenshot of a video posted on California Recovery Group’s website shows an unidentified woman as she relays her happy experience with the company, which she said resulted in a check that will cover the cost of smoke damage.

Was this article valuable?

Here are more articles you may enjoy.

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  These Five Technologies Increase The Risk of Cyber Claims

These Five Technologies Increase The Risk of Cyber Claims  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk