At the same time US motorists have become more accident prone, they have grown impatient with insurers because of how long it’s takes to resolve their auto claims.

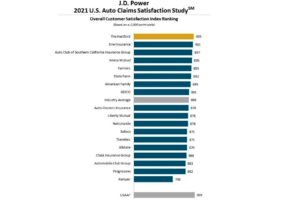

J.D. Power reported Thursday that the average customer satisfaction score for auto insurance claims sank seven points (on a 1,000 point scale) to 873 in its latest consumer survey.

“Insurers are in a tight spot with their own profitability strained and a host of external factors causing their customers to grow increasingly disillusioned with the entire claims experience,” stated Mark Garrett, director of global insurance intelligence for the consumer research firm. “The best way forward is for insurers to start focusing on carefully managing customers’ expectations and fine-tuning their digital engagement strategies to shepherd their customers through the process.”

J.D. Power noted that the volume of vehicle collisions is returning to pre-pandemic levels, repair costs have reached all-time highs and consumers are facing “historic backlogs” at repair shops because of limited parts availability.

On a more positive note, insurers that managed customer expectations, promptly responded to customers and provided multiple digital options for status updates were rewarded with higher customer satisfaction scores. Some even improved in that regard, despite the general downward trend.

Garrett said in a telephone interview that any “period of uncertainty” frustrates policyholders. He said insurers that offered multiple digital channels — texts, apps, and email — to keep customers informed about what to expect next performed better than their counterparts.

“Digital is a big win this year for companies that improved and outpaced the industry,” he said.

The survey found that when digital channels are used for delivering status updates, overall customer satisfaction rises 56 points. When digital is used to report first notice of loss using the internet or an app, overall satisfaction falls 4 points.

This year’s consumer survey found that text messaging became the second most popular means of communicating insurer claims managers. Email remained No. 1. Push notifications and app downloads were less popular options for insurance customers, Garrett said.

Insurers also need to retain the human touch. The survey found that 34% of customers had a stronger preference for working with people rather than using digital contact. Customer satisfaction ratings for those customers was 31 points lower than customers who said they were equally comfortable with human interaction and digital channels, the report says.

A common customer complaint about auto claims is that they must interact with three or more representatives during the claims process. Scores are highest for insurers that use straight-through processing technology to automatically approve and route the claim.

The Auto Claims Satisfaction Study is based on responses from 8,239 auto insurance customers who settled a claim within the past six months prior to participating in the survey, J.D. Power said.

Was this article valuable?

Here are more articles you may enjoy.

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  These Five Technologies Increase The Risk of Cyber Claims

These Five Technologies Increase The Risk of Cyber Claims  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo