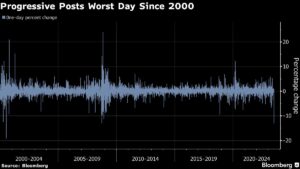

Shares of Progressive Corp. fell the most since 2000 after the insurance company released second quarter results that missed analysts’ estimates.

The stock tumbled by about 13% on Thursday, following the report that its combined ratio — a measure of underwriting profitability — came in worse than expected. Mayfield Village, Ohio-based Progressive was the worst performer among S&P 500 stocks on the day. Shares of the company closed at around $115 Thursday, after ending Wednesday at about $132.

For an insurer, a combined ratio of less than 100% would signal that it’s bringing in an underwriting profit, or in other words, taking in more from premiums than it is spending on claims. For the second quarter, Progressive’s combined ratio came in at 100.4%, meaning the company spent one dollar and four cents on claims and expenses for every premium dollar received. The figure is also higher than analyst estimates compiled by Bloomberg of 97.1%.

“Progressive’s June month was one of the toughest it has suffered in recent years,” Piper Sandler & Co. analyst Paul Newsome wrote in a note to clients. “The bottom line is that the profitability and reserving problems at Progressive are bigger than we expected.”

Piper Sandler’s Newsome, who holds a neutral rating on the stock, lowered his price target to $126 from $136.

Piper Sandler’s Newsome, who holds a neutral rating on the stock, lowered his price target to $126 from $136.

“Some of the June result is just bad luck from catastrophe losses, but the underlying combined ratio is not snapping back as fast as many would have expected even with Progressive’s exceptional operating expense management,” he wrote.

Other insurance stocks also underperformed on the day, including Allstate Corp. which dipped 2.6% and Travelers Companies Inc. which was down 1.7%. The results from Progressive show that auto insurers are “continuing to be impacted by elevated severity,” Wells Fargo & Co. analyst Elyse Greenspan wrote in a note to clients.

A greater frequency and severity of accidents, combined with higher costs to repair or replace damaged vehicles, have pummeled auto insurers this year. More broadly, property and casualty players have struggled to maintain profitability as they deal with those factors as well as heightened costs linked to extreme weather events.

An S&P Global Market Intelligence report for 2023 sees the insurance industry closing out the year with a combined ratio of 100.8% — essentially meaning that, for every dollar of premium insurers take in, a dollar and eight cents will go toward claims.

“While that marks an improvement from the calendar-year 2022 result of 102.6%, it remains above the 100.0% threshold that serves as the metaphorical break-even point for underwriting profitability,” reads the report. “We project a return to a sub-100% combined ratio in 2024.”

Was this article valuable?

Here are more articles you may enjoy.

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  These Five Technologies Increase The Risk of Cyber Claims

These Five Technologies Increase The Risk of Cyber Claims  Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims