Total global insured losses from natural catastrophes of more than $100 billion a year may be less newsworthy than in the past. In fact, the industry should expect loss totals of at least $100 billion every year, according to models from data and analytics firm Verisk.

Average losses over the last 5 years is $101 billion, an increase from an average of $70 billion over the previous five years, 2013-2017. Now, Verisk’s models say the average annual loss from global natural catastrophes is $133 billion – a new high – driven by factors other than weather.

“The growth in exposure values, driven primarily by continued construction in high-hazard areas, and rising replacement costs – largely due to inflation – are the most significant factors responsible for increasing catastrophe losses,” Bill Churney, president of Verisk extreme event solutions, said in a statement. “The other significant factor is the impact of climate change, which is often cited as the primary reason for the increase in losses. But, while this plays a role, year-over-year growth of exposure and rising replacement values have a far greater short-term impact.”

Adding to the findings, Verisk said its global average annual losses should be considered a baseline. With an increase in frequency for significantly higher losses, Verisk said the industry should prepare for the possibility of a year of losses in excess of $200 billion.

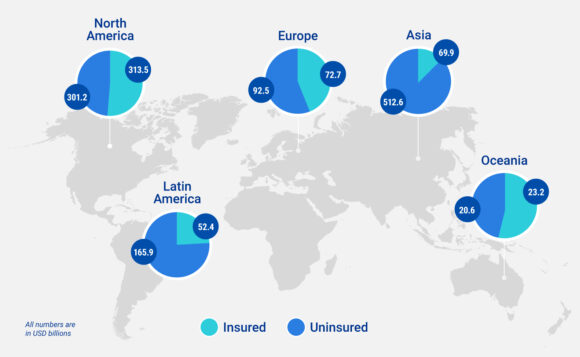

Verisk said its models also highlight a significant gap in insurance protection, with annual global economic losses in excess of $400 billion.

“On a regional basis, the percentage of economic loss from natural disasters that is insured varies considerably,” Verisk said in its report, 2023 Global Modeled Catastrophe Losses. “In North America, for example, about 51% of the economic loss from natural disasters is insured, while in Asia, insured losses account for only about 12% of economic losses, respectively, reflecting the very low insurance penetration in these regions.”

Verisk said it does not distinguish between so-called “primary” and “secondary” perils, as all catastrophes contribute to loss, “whether they are a single major event, an aggregation of smaller ones, or a combination of the two.” Severe thunderstorms, often referred to as a secondary peril, have accounted for 70% of insured losses from eight multi-billion dollar events in 2023 so far, Verisk said.

Climate change is a “significant factor” in the increase of catastrophe losses, impacting all perils, said Verisk, adding that “perils like floods, droughts, wildfire, and sea level rise (and therefore storm surge) are becoming more severe and the observational data corroborates the science.” The contribution of climate change on other perils is more difficult to quantify but Verisk said it is working to combine the science with historical trends to ensure the models reflect climate risk.

Was this article valuable?

Here are more articles you may enjoy.

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads