Even though Berkshire Hathaway’s latest annual report featured Warren Buffett’s forecast that the days of “eye-popping performance” for the giant conglomerate are over, readers focused on property/casualty insurance saw numbers that jumped off the pages.

Among them were:

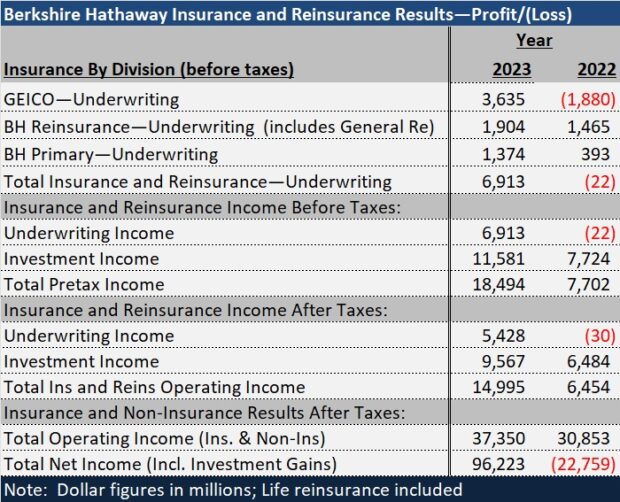

- A 2023 pretax underwriting profit of $3.6 billion, reversing a $1.9 billion underwriting loss reported for 2022 at Berkshire’s personal auto insurance operation, GEICO, and fueling a $5 billion pretax underwriting profit for all of Berkshire Hathaway’s insurance operations last year.

- 2023 underwriting profits for the remainder of primary operations coming in three-times higher than 2022 and more than double 2021, with written premiums growing 24.1 percent to $3.5 billion.

- P/C reinsurance operations adding another $2.0 billion in pretax underwriting profit. The last time P/C reinsurance came in even close to that figure was more than a decade ago in 2013, when P/C reinsurance underwriting profits reached $1.0 billion (according to records kept by Carrier Management)

In his annual letter to shareholders, Buffett highlighted insurance and reinsurance company profit results as the bright spot of the earnings picture for 2023. While operating earnings for Berkshire’s railroad and energy businesses were lower in 2023 than 2022, insurance and reinsurance underwriting income of $6.9 billion pretax, or $5.4 billion after taxes, reversed losses in the millions ($22 million pretax and $30 million after taxes) in 2022. Insurance investment income came in nearly 50 percent higher in 2023, adding another $10 billion to after-tax operating income.

P/C insurance “provides the core of Berkshire’s well-being and growth,” Buffett wrote. “We have been in the business for 57 years, and despite our nearly 5,000-fold increase in volume—from $17 million to $83 billion—we have much room to grow,” he said. (Note, the chart below excludes $5 billion of life reinsurance premiums.)

Buffett’s much-reported comment that Berkshire Hathaway has “no possibility for eye-popping performance” for shareholders came early in the letter as he compared the net worth of Berkshire ($561.3 billion) in shareholders equity—”the largest GAAP net worth recorded by any American business”—to the roughly $9 trillion in GAAP net worth of the rest of the S&P 500.

Related article: “Buffett Says Berkshire ‘Built to Last’“

“By this measure, Berkshire now occupies nearly 6 percent of the universe in which it operates. Doubling our huge base is simply not possible within, say, a five-year period,” he wrote.

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” he said, describing his criteria for acquisitions that could bring some pop to Berkshire’s stock price.

GEICO: Losses and Staff Numbers Tumble

While Berkshire’s most recent acquisition in the P/C insurance and reinsurance world, the $11.6 billion deal for Alleghany Corporation (which closed in October 2022), provided jolts to premium volume totals for Berkshire Hathaway’s primary commercial insurance and reinsurance businesses (discussed below), it was the turnaround of Berkshire’s personal lines insurance operation, GEICO, that really moved the needle—pushing overall insurance and reinsurance underwriting figures from red to black.

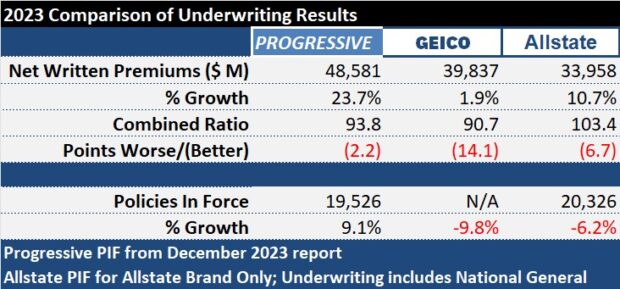

GEICO’s $3.6 billion pretax underwriting profit translates to a 90.7 combined ratio, more than 14 points below the 104.8 recorded in 2022. The only better year of underwriting performance at GEICO in the last 10 was 2020, when COVID shutdowns kept drivers off the roads. In 2020, GEICO’s combined ratio landed at 90.2, fueling a $3.4 billion pretax underwriting profit.

GEICO’s $3.6 billion pretax underwriting profit translates to a 90.7 combined ratio, more than 14 points below the 104.8 recorded in 2022. The only better year of underwriting performance at GEICO in the last 10 was 2020, when COVID shutdowns kept drivers off the roads. In 2020, GEICO’s combined ratio landed at 90.2, fueling a $3.4 billion pretax underwriting profit.

GEICO’s combined ratio improvement in 2023 looks stunning against competitors Progressive and Allstate, which both posted double-digit premium jumps in 2023 but smaller improvements in their personal auto combined ratios. (Editor’s Note: State Farm has not reported earning yet).

At GEICO, earned premiums grew less than 1 percent in 2023, and written premiums grew just under 2 percent.

In the Management Discussion and Analysis section of the annual report published Saturday, Berkshire reveals that 12.4 points of GEICO’s combined ratio improvement came from a $4.5 billion decline in loss and loss adjustment expenses, while the other two points came from $752 million in expense cuts. The report attributes the 12.4 percent drop in loss and loss adjustment expenses to lower claims frequencies and increased favorable loss reserve development for prior accident years, partially offset by increases in average claims severities. Also noted is the fact that while rate hikes pushed average premiums per policy up 16.8 percent, policies in force declined 9.8 percent, impacting overall premium growth for the year.

Providing details of the loss drivers, the report reveals that:

- Prior-year reserve takedowns amounted to $1.5 billion in 2023, compared to $653 billion in 2022.

- Results for 2022 also included the impact of $400 million in losses from Hurricane Ian.

- Property damage and collision claims frequencies dropped 7-8 percent last year, while average claim severities for all coverages rose in the 14-16 percent range.

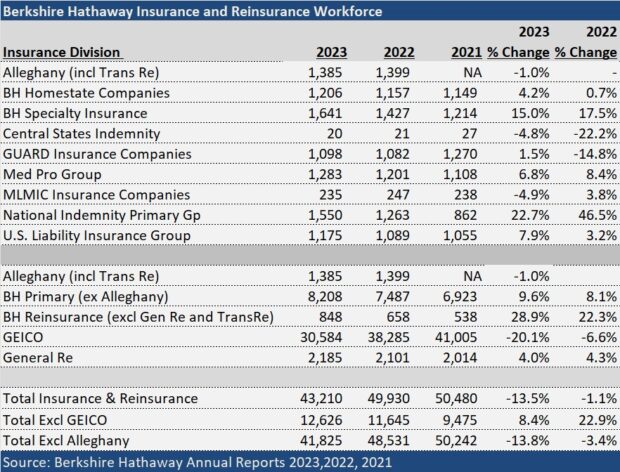

Beyond the 12 percent drop in auto insurance losses, another eye-popping figure for GEICO is 20 percent drop in staffing—a loss of 7,700 employees—that become evident to anyone comparing a page in the report’s appendix to a similar page in last year’s report.

An employee count for all of Berkshire Hathaway’s operating entities (insurance and non-insurance) is a regular feature of the conglomerate’s annual report. This year, page 149 of the 152-page annual report lists GEICO’s employee count as 30,584, compared to a 38,285 figure reported last year.

If the latest staffing figure has been accurately reported, then GEICO’s employee count has fallen below the level reported 10 years ago in 2014, and the 2023 drop marks three straight years of workforce reductions (2.7 percent in 2021, 6.6 percent in 2022 and 20.1 percent in 2023). The declines came after successive increases for at least eight years (the period for which Carrier Management has tracked the reported figures).

Notably, while the downward change in employee counts for 2023 likely encompasses a 6 percent reduction in force from a layoff notice widely reported by media outlets in October, there are 5,700 remaining positions gone that are not explained by the layoff.

(Carrier Management was not able to confirm the accuracy of the employee counts at press time but has reached out to GEICO for information on the reported figures.)

The report’s discussion of GEICO’s results cites lower employee-related costs as one of the drivers of a nearly 3.0-point improvement in its expense ratio in 2022 but doesn’t specifically flag employee costs as a driver of the further 2.0-point improvement in 2023. The report attributes last year’s improvement to “reduced advertising expense and improved operating leverage.”

Reinsurance and Primary Ops: Record Profits

The remaining insurance and reinsurance operations generally added to their workforces, according to figures in the 2022 and 2023 reports, also taking premiums and underwriting profits to record levels.

The primary insurance operations, writing mainly commercial lines, recorded $1.4 billion in underwriting profits on $3.5 billion of written premiums. The MD&A discloses that a 24.1 percent jump in premiums in 2023 was primarily attributable to Alleghany operations RSUI and CapSpecialty ($2.1 billion). Other larger jumps (amounts undisclosed) came from the Berkshire Hathaway Specialty Insurance and Berkshire Hathaway Direct operations.

While earned premiums grew about 25 percent for all the primary ops taken together, their losses increased by 13.5 percent, driving over 6 points of improvement in the loss ratio for the group of companies. The report notes that lower amounts of catastrophe losses ($37 million in 2023 vs. $641 million in 2022) and changes in business mix helped bring down the loss ratio.

The P/C reinsurance operations recorded a 32 percent jump in written premiums to $22.4 billion, including Alleghany’s TransRe Group. Excluding TransRe, the jump was still sizable, coming in at 17.1 percent, as Berkshire leaned into higher priced property reinsurance business last year.

Overall, the loss ratio for the P/C reinsurance operations dropped 6.4 points in 2023, with a lower level of catastrophes helping to improve the result. The reinsurance cat losses came in at $900 million in 2023, compared to $2.0 billion in 2022.

Editor’s Note: Charts included earlier in this article include results for life reinsurance and retroactive reinsurance operations.

Was this article valuable?

Here are more articles you may enjoy.

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  China Bans Hidden Car Door Handles in World-First Safety Policy

China Bans Hidden Car Door Handles in World-First Safety Policy