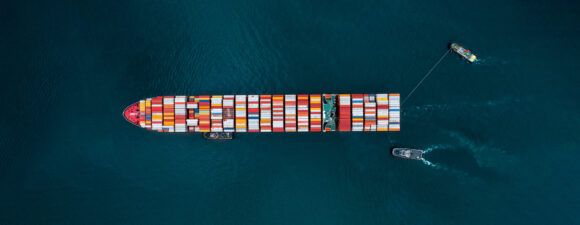

Risk is the “new normal” for the global ocean shipping industry that handles 80% of global trade as pressure from geopolitical tensions, rising protectionism and climate change mounts.

“There are going to be global tensions … and I think global dangers, at a level we haven’t seen since the end of World War II,” former U.S. Defense Secretary Robert Gates said at the opening of S&P Global’s TPM24 container shipping conference in Long Beach, California, on Monday.

Houthi missile and drone attacks on merchant ships in the Red Sea and Gulf of Aden are top of mind, but far from the only concerns, for the 4,000 attendees at the conference that runs through Wednesday.

“The relatively relaxed environment in which you have operated for a long time until fairly recently, is probably a thing of the past for at least some considerable period,” Gates told the audience.

The ocean shipping industry entered this year with the highest degree of risk in the 25 years that S&P Global Market Intelligence has been creating that forecast, Chris Williamson, the company’s chief business economist, said.

Beyond the Red Sea attacks, half of the world’s population is going to the polls this year, which may bring more protectionist policies that include tariffs on major exporters, such as China, he said.

That trend, coupled with climate change-related costs, such as routing around the drought-stricken Panama Canal, could fuel inflation that threatens a hoped-for “soft landing” for the global economy, Williamson said.

The Red Sea attacks already have spurred cargo delivery disruptions and soaked up excess vessel capacity – raising shipping costs in what has been a sluggish cargo volume recovery.

Container ship owners have been diverting vessels away from the Red Sea and the nearby Suez Canal trade shortcut that handles as much of 30% of the world’s container cargo – including clothing, furniture, auto parts, chemicals, machinery and coffee.

The longer, alternate route around Africa’s Cape of Good Hope adds five days or more to trips and as much as $1 million in one-way fuel costs. Spot shipping rates soared, doubling or tripling on some journeys, and remain elevated.

Iran-affiliated militants in Yemen have sunk one ship – the UK-owned Rubymar – in their campaign that started in November and are undeterred despite retaliatory attacks from a U.S.-British coalition and other navies. The Houthis last week vowed to down more ships in assaults they say are in solidarity with Palestinians affected by Israel’s military actions in Gaza.

(Reporting by Baertlein in Los AngelesEditing by Tomasz Janowski)

Was this article valuable?

Here are more articles you may enjoy.

China Bans Hidden Car Door Handles in World-First Safety Policy

China Bans Hidden Car Door Handles in World-First Safety Policy  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case