Ports along the US East Coast are modifying their operations to absorb cargo diverted from Baltimore harbor, where salvage specialists are starting the daunting task of clearing debris from the destroyed Francis Scott Key Bridge.

The Port of Virginia, with terminals at the mouth of the Chesapeake Bay near Norfolk, is opening a gate Monday at 5 a.m. — an hour earlier than usual — to help accommodate more truckers. The Port of New York and New Jersey, which is expecting additional cargo including autos, is working to allow quick access for transport companies that usually go through Baltimore. A major railroad is expanding its services, too.

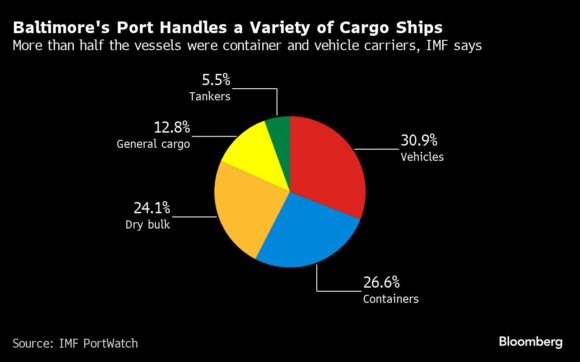

Fallout from last week’s deadly bridge collapse, which indefinitely closed the nation’s 17th-largest port by total cargo tonnage and the busiest gateway for vehicles, is expected to be largely contained as neighboring facilities with spare capacity tweak their schedules. Snarls, delays and added costs are more likely to appear outside ports as tens of thousands of shipments require longer routes on already-crowded roadways and rail lines.

Insurance Industry Readies for Historic Losses From Baltimore Bridge Tragedy

“The ports on the East Coast can easily absorb the immediate aftermath on containerized trade,” said Sanne Manders, president of international operations at Flexport Inc., a digital freight platform. “The longer-term aftermath will probably be more severe, because even if you take away the debris from the port, that is an extremely important bridge as a feeder into the port, and traffic will have to reroute a long, long way.”

CSX Corp., the Jacksonville, Florida-based railroad, said it’s starting to offer a rail service designed to move diverted Baltimore freight from New York.

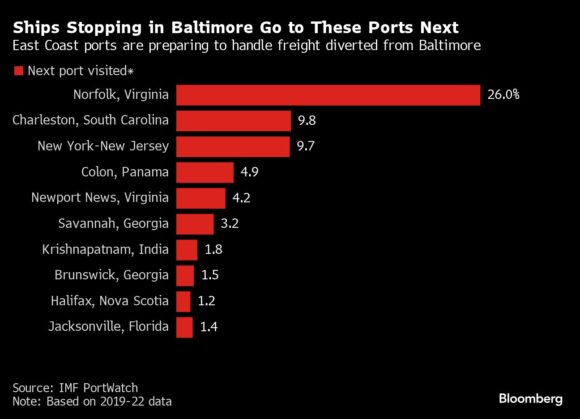

Norfolk, New York and Charleston, South Carolina, are most often the next destinations for cargo ships leaving Baltimore on scheduled routes, according to an analysis from the International Monetary Fund’s PortWatch platform. That makes them the likeliest to absorb more imports in the short term.

As of Sunday, there were 29 bulk cargo, container and vehicle carriers anchored outside 10 ports between Boston and Jacksonville, compared with 18 on Saturday, according to satellite tracking data compiled by Bloomberg.

While there’s no timeline yet for reopening the Baltimore channel, giant cranes are being put in place to begin dismantling wreckage from the bridge, US Transportation Secretary Pete Buttigieg said Sunday. It’s important “to our national supply chains to get that port back up and running as quickly as possible,” he said on CBS’s Face the Nation.

Officials plan to establish a temporary alternate channel on the northeast side of the main channel in the vicinity of the Francis Scott Key Bridge for commercially essential vessels, according to an update late Sunday from Baltimore City Mayor Brandon Scott.

The temporary channel will be marked with government lighted aids for navigation and have a controlling depth of 11 feet, a 264-foot horizontal clearance and vertical clearance 96 feet. The current 2,000-yard safety zone around the Key Bridge remains in effect.

Maryland Governor Wes Moore said the port closure will have ripple effects across the eastern US. “This port is one of the busiest inside the country, so this will impact the farmer in Kentucky, and the auto dealer in Ohio and the restaurant owner in Tennessee,” he said on CNN’s State of the Union.

Gateways including New York’s and Virginia’s are handling about 20% less volume than they were during their pandemic peaks, leaving officials confident they have the extra capacity to avoid extended bottlenecks.

If all goes to plan, truck drivers who normally book pick-up and drop-off appointments in Baltimore should be able to do so this week at terminals elsewhere in the region.

“The Port of New York and New Jersey is proactively working with our industry partners to respond as needed and ensure supply chain continuity along the East Coast,” port director Bethann Rooney said in an emailed statement.

According to data released by FourKites Inc., a supply-chain visibility platform, the diversions are adding five days to the delivery times on ground modes of transportation.

“Even once they remove the rubble from the water, traffic in the area will be impacted as truck drivers become reluctant to take loads in and out of the region without a price increase,” said Jason Eversole, vice president of professional services at FourKites.

The local devastation wrought by the crumbled bridge and the closure of Baltimore’s port will linger in the region for a few months, several economists said.

Though relatively small in economic impact, it’s another stark example of the kinds of supply-chain shocks to a globally connected hub that have sent shudders through corporate boardrooms and political circles about the need for more resilience and self-sufficiency.

Those kinds of jolts have been felt across the world, including by ships sailing around Africa to avoid Houthi attacks in the Red Sea, or delays transiting the drought-stricken Panama Canal.

And other shocks just damage local economies — including a port strike in Finland; South Africa’s unreliable logistics infrastructure; and a container ship that crashed into dockside cranes in a Turkish port earlier this month.

“Trade is actually holding up pretty well — trade flows are still moving, companies are finding workarounds, and most of this disruption seems to be rather temporary,” said Shanella Rajanayagam, a trade economist with HSBC Holdings Plc in London.

HSBC economists recently boosted their forecast for world trade growth this year to 2.5% and maintained their outlook for a 3.4% expansion in 2025. That would be a marked improvement from 2023, which many observers expect will show little to no growth once final figures are compiled.

Rajanayagam said that although container shipping rates from Asia to the US East Coast might spike temporarily in the aftermath of the Baltimore disaster, the bigger risks to global commerce are those involving geopolitics, protectionism, election-year uncertainty and climate change.

“It all seems to be pointing to the downside rather than to the upside, so it makes sense to brace for those shocks,” she said.

Top photo: The Dali container vessel after striking the Francis Scott Key Bridge that collapsed into the Patapsco River in Baltimore on March 26, 2024. Photo credit: Al Drago/Bloomberg.

Was this article valuable?

Here are more articles you may enjoy.

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand