The 7.2 magnitude earthquake that struck Taiwan’s east coast on April 3 caused substantial damage, particularly in Hualien with collapsed buildings and infrastructure disruptions. However, insurers are expected to weather the financial impact well, according to GlobalData, the London-based data and analytics company.

Government-backed schemes are anticipated to mitigate losses, although insurers may re-evaluate risk exposure and adjust premiums to maintain profitability, GlobalData said.

Property insurance claims are expected to account for an 11.6% share of the total general insurance claims in 2024, amounting to TWD14.1 billion ($500 million), GlobalData estimated, noting, however, that actual claims in 2024 might increase once the complete impact of the earthquake is realized.

Worst Taiwan Quake in 25 Years Kills at Least 9, With Hundreds Injured

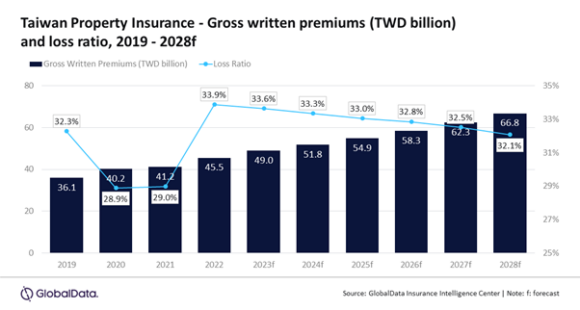

Despite the losses, the overall profitability of the general insurance industry in Taiwan is not expected to be significantly affected, as the average loss ratio of property insurance remained low at 31.5% during 2019–23, the company said.

“Being located in one of the three major seismic regions globally, Taiwan is prone to natural calamities, especially earthquakes. As a result, the penetration of earthquake insurance is moderately high in Taiwan, and the current earthquake is expected to result in high claims for local insurers and reinsurers,” commented Aarti Sharma, Insurance Analyst at GlobalData, in a statement.

However, GlobalData explained that most of the losses will be borne by the Taiwan Residential Earthquake Insurance Fund (TREIF), which was established by the government in 1999 to create an earthquake insurance pool and strengthen the earthquake insurance mechanism in the country.

Earthquake insurance underwritten by general insurers is ceded to the TRIEF which retains most of the risk and transfers the remaining to domestic and international reinsurers. Effective April 1, 2024, the liability assumption limit of the residential earthquake insurance’s risk has been increased to TWD120 billion ($3.7 billion).

“[I]n the short term, to maintain profitability, property insurers might re-assess their risk exposure, which is expected to increase the premium rates for property insurance policies and support property insurance growth.”

As a result, the property insurance industry is expected to grow from TWD51.8 billion ($1.7 billion) in 2024 to TWD66.8 billion ($2.2 billion) in 2028, in terms of gross written premiums (GWP) at a compound annual growth rate (CAGR) of 6.5% over 2024–28, GlobalData said.

With the considerable impact of the recent earthquake on residential and commercial property, the demand for fire and natural hazard policies that cover earthquake insurance is also expected to increase in 2024 and 2025, the company continued.

Fire and natural hazard policies are expected to account for an 80.4% share of total property insurance GWP in 2024, it said.

“The recent earthquake could translate into higher claims than anticipated for insurers and reinsurers in Taiwan. The increased frequency of such large-scale natural calamities is expected to further create demand for the fire and natural hazard policies in the country, which will support property insurance growth over the next five years,” Sharma continued.

The reported death toll on April 5 was 12, with a dozen people missing.

Top photo: Debris surrounds a titled building a day after a powerful earthquake struck Hualien City, eastern Taiwan, on Thursday, April 4, 2024. (AP Photo/Chiang Ying-ying)

Was this article valuable?

Here are more articles you may enjoy.

Berkshire Utility Presses Wildfire Appeal With Billions at Stake

Berkshire Utility Presses Wildfire Appeal With Billions at Stake  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms