In 2022, a covert practice by unscrupulous lawyers targeting insurers was uncovered by Demotech Inc., a financial analysis firm serving the property/casualty insurance sector.

Demotech’s research conducted with Todd Kozikowski exposed troubling trends detailed recently.

A sharp rise in claims litigation against certain insurers that had ceased writing new business, shed policies or reduced underwriting was observed in 2022.

The growth exceeded what was expected due to rampant lawyer advertising, prompting Demotech to engage Kozikowski, an expert in data analytics and artificial intelligence, to explore the role of technology in this phenomenon.

The research revealed the “tech-enabled claim instigation” business model: a combination of search engine optimization (SEO), litigation marketing, litigation analysis platforms and litigation financing aimed at originating contested claims.

The model heavily targets the transportation and logistics sector and commercial automobile liability insurance providers.

The Impact of Tech-Enabled Claim Instigation on Supply Chains and Transportation

Commercial auto liability insurers identify “nuclear verdicts” and “social inflation” as major contributors to deteriorating operating results.

Demotech believes the targeting of insurers and trucking companies is a major cause.

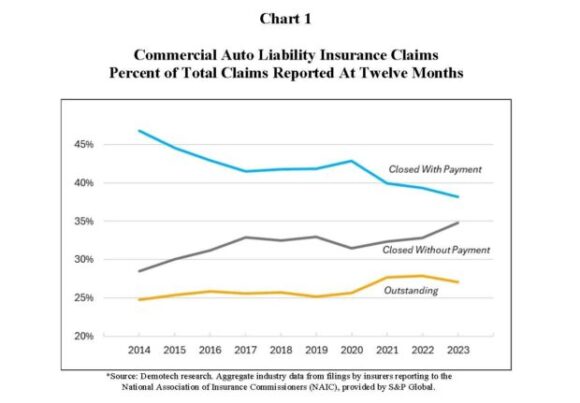

A review of countrywide commercial automobile liability claim counts from 2014 to 2023 revealed significant trends, as shown in Chart 1.

Declining Percentage of Claims Closed with Payment (blue line): The faster a claim is closed, the less it costs. A declining trend in quick settlements means rising claim costs in commercial automobile liability.

Rising Percentage of Claims Closed Without Payment (gray line): While appearing to be favorable at first glance, this trend indicates increased defense costs for insurers, likely due to the scaling and economies of using litigation platforms to crate and file contested claims.

Increasing Percentage of Claims Outstanding (orange line): More human and financial resources are required to settle these claims – even those that don’t result in indemnity – further straining insurers and self-insured entities.

Saturation by an increasing number of litigated claims can overwhelm limited resources of state judicial systems, benefiting opportunists, as prolonged settlements result in higher costs, the Demotech findings indicate.

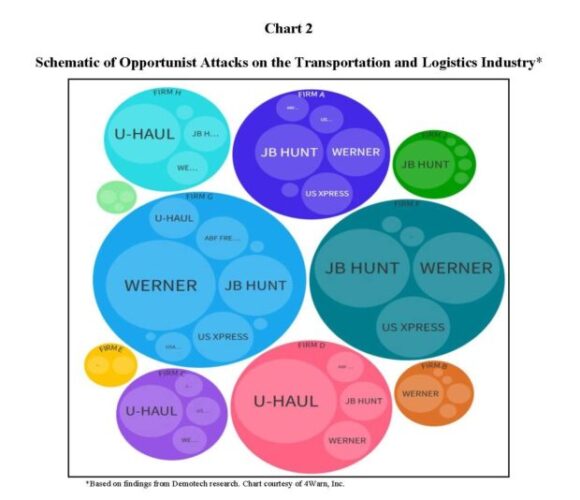

Evidence of the impact of tech-enabled claim instigation on the transportation and logistics industry is seen in the online targeting of specific companies by multiple entities seeking to instigate contested claims, according to the analysis (see Chart 2).

The size of each bubble in the chart indicates the scope of a specific opportunist’s online presence relative to the other opportunists reviewed.

The size of a targeted entity within a bubble represents the entity’s degree of targeting by the opportunist.

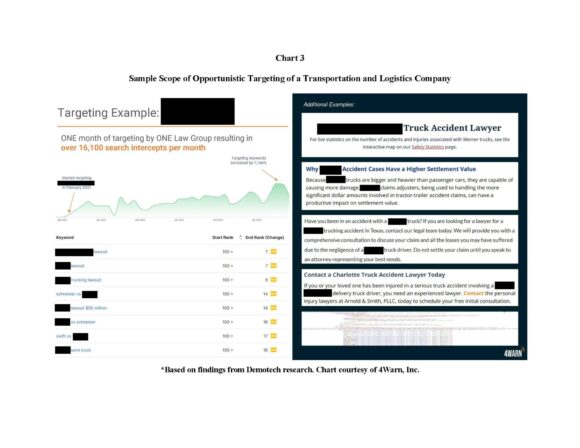

The diagram in Chart 3 highlights key discoveries of Demotech research relative to an individual supply chain logistics company.

Demotech and Kozikowski uncovered the existence of a nationwide business model that leverages search engine optimization, litigation financing and marketing to use AI capabilities of litigation platforms to generate contested claims.

This tech-enabled claim instigation drives social inflation and nuclear verdicts, making insurance less available and affordable, according to the analysis.

Absent effective responses by targeted insurers, tech-enabled claim instigation will continue to escalate, fostering more litigation financing in an endless cycle, according to Demotech.

Was this article valuable?

Here are more articles you may enjoy.

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  China Bans Hidden Car Door Handles in World-First Safety Policy

China Bans Hidden Car Door Handles in World-First Safety Policy  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts

UBS Top Executives to Appear at Senate Hearing on Credit Suisse Nazi Accounts