The saga of the Murdaugh family in South Carolina continues, now with a convenience store company suing its liability insurers for failing to defend it against a second lawsuit stemming from the sale of beer to an underage Paul Murdaugh on a fateful night in 2019.

The lawsuit in federal court in Georgia could add to the simmering debate over the high cost of liability insurance for establishments that sell alcohol in South Carolina, a cost that has driven a number of restaurants, bars and venues to close in the last two years.

In the complaint filed late last week, Parker’s Corp. and its principal officers charge that Amerisure Insurance Co. and Utica Mutual Insurance breached the insurance contract by denying coverage for a lawsuit filed by the estate of a young woman killed in a boat crash – a boat allegedly driven by the underage and intoxicated son of Alex Murdaugh.

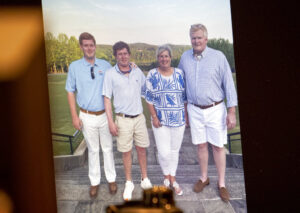

The elder Murdaugh is a former well-known South Carolina attorney who was convicted in 2023 of murdering his wife and his son, Paul, in 2021.

Insurers for Parker’s, which owned the waterfront convenience store that sold alcohol to Paul Murdaugh before the fatal boat accident, last year agreed to pay some $15 million to settle the young woman’s family’s initial suit against the store operators. That was known as the “boating lawsuit.”

In 2021, the estate of deceased Mallory Beach filed a second lawsuit, known as the “outrage lawsuit,” against Parker’s, alleging that the store company had leaked videos, previously used in a related mediation, of some of the events that night, along with photographs of Mallory’s body. The images were reportedly provided to a documentary filmmaker, the outrage suit contends.

“The Outrage lawsuit also falsely contends that Parker’s, Mr. Parker, Mr. Greco, and Mr. D’Cruz worked with private investigators to launch a social media campaign to inflict emotional distress on the Beach Family ‘to diminish their resolve’ to prosecute their claims against Parker’s in the Boating Lawsuit,” Parker’s complaint against its insurers explains.

The Parkers and the others named in the outrage suit have denied the allegations. But they say they still need Amerisure and Utica to defend them in the potentially costly litigation. Both commercial liability policies provided $1 million per occurrence and an aggregate limit of $2 million.

The insurers have not yet filed an answer to the Parker lawsuit. But the complaint notes that the carriers sent declination letters in 2022 denying the coverage: Amerisure argued that the mediation video was leaked before the policy period began and that the policy excludes coverage for claims regarding material that was provided illegally.

Parker’s Corp. countered that the underlying outrage suit does not allege violations of the law, and that the date the video was leaked is only an allegation made by the Beach family.

Utica denied coverage and legal defense on the grounds that the outrage suit does not involve bodily injury, per the terms of the insurance policy. The policy also does not cover harm from publication of “non-public information,” and does not cover personal and advertising injury resulting from the publication of material that the insureds knew to be false, Utica said, according to the Parker complaint.

“Furthermore, Utica is estopped from asserting any coverage defenses not expressly included in its January 27, 2022 denial letter because an insurer is not permitted in Georgia to deny coverage and at the same time to reserve its rights later to assert other bases for the coverage denial,” the Parker suit argues.

The Parker Corp., which owns convenience stores in Georgia and South Carolina, is asking the U.S. District Court in Northern Georgia to declare that the insurance companies must defend the store company in the outrage lawsuit, and to award damages to Parker’s for the insurers’ failure to defend.

The selling of the alcohol to Paul Murdaugh, who reportedly used his older brother’s identification card, that night in 2019 and the subsequent insurance settlement have been cited as an example of how South Carolina’s “joint-and-several” liability laws have caused insurance premiums to soar, putting multiple places out of business.

Critics have said the law does not allow apportionment of fault but lets juries pin most of the damages on defendants with the deepest pockets or best insurance coverage. Although several other establishments sold booze to Murdaugh and friends that night, Parker’s store was facing the bulk of the damages.

The South Carolina General Assembly this year did not approve a number of bills, including ones that would have repealed the joint liability law and others that would have provided insurance pools to eating and drinking establishments.

Was this article valuable?

Here are more articles you may enjoy.

China Bans Hidden Car Door Handles in World-First Safety Policy

China Bans Hidden Car Door Handles in World-First Safety Policy  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims