With restaurant sales projected to top $1 trillion and reach record-breaking heights this year, a California-based insurance technology company versed in the space recently analyzed data from more than 30,000 small business restaurant owners across the U.S. to determine the most frequent and severe claims they face.

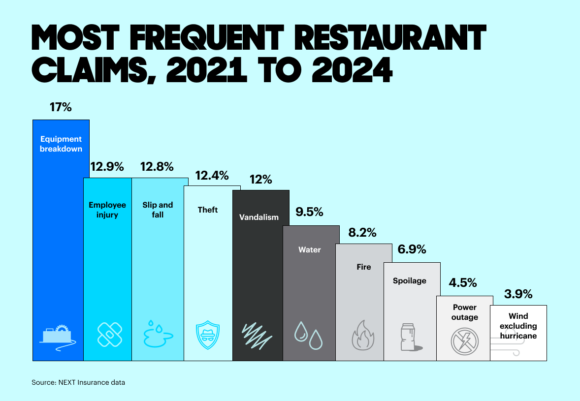

Equipment breakdown, employee injury, customer slip and fall, theft and vandalism were the five most frequent claims at restaurants from January 2021 to July 2024, according to the new report from NEXT Insurance.

Water damage, fire, food spoilage, power outage and wind (excluding hurricanes) rounded out the top 10 on the list, which was compiled from findings that come from anonymized data from small businesses that purchased insurance from NEXT.

“By analyzing a four-year snapshot of our restaurant data, we’re able to uncover trends that not only aid in risk assessment but also empower small businesses to plan for growth and future success,” said Effi Fuks Leichtag, chief product officer at NEXT.

The report also shared select state-level numbers.

The top claim driver in Pennsylvania was equipment breakdown, while employee injury claims topped the list in Florida. Vandalism was the primary driver in California.

Fire was the top claim source in both New Jersey and Tennessee. Mississippi’s top claim cause was wind (excluding hurricanes), spoilage claims topped the list in Michigan and power outages were No. 1 in Virginia.

Data from the study period shows restaurants with a business insurance claim had an average total loss of around $9,000. Fine dining restaurants took the biggest loss per business, with average claims nearly double of all restaurants.

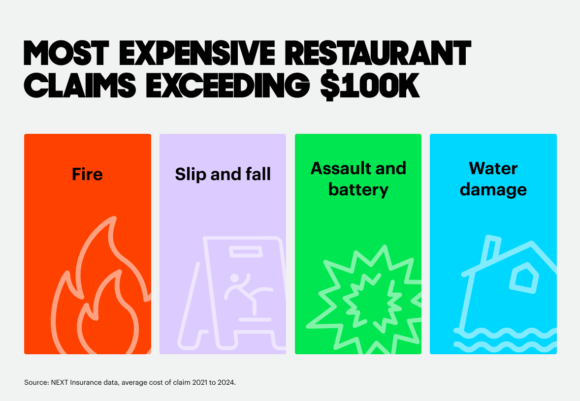

The report shows that the top four most expensive restaurant claims from 2021 to 2024 were fire, slip and fall, assault and battery and water damage.

Leichtag said that the claim severity “falls off a cliff” after those big four.

When asked about emerging risks, Leichtag said that NEXT is seeing restaurants reduce the number of employees per dollar of revenue. So, even when payroll relatively increases, fewer employees are being hired, he explained.

“Now, if we associate it to automation and the ability to do more, and we see more small restaurants [implementing] cooking technology, point of sale self-ordering that you see in the kiosks — that means that even if the employee injury aspect is getting better through training or just better safety, the damage of an employee incapable of working is much more dramatic,” Leichtag said. “Right? Because you’re just dependent on less and less individuals. So, it has both a positive and a negative effect. The positive is restaurants need less employees to operate [and] they can pay them more. We see it. The negative is if that employee is quitting or injured or a claim has happened and the employee cannot be there, that can be negative.”

Equipment breakdowns could be amplified by similar challenges. From a hardware perspective, if restaurants become more reliant on automated and internet-connected devices to order, cook or serve their food, internet outages can “turn off a business,” according to Leichtag.

Many restaurants don’t accept cash as payment and must temporarily close during outages because they can’t collect money.

Separately, compromising on workers’ compensation can be “devastating” for restaurant owners, Leichtag said. He said that restaurants are among the hardest businesses to run, and it may be tempting for owners to see employee protection—not benefits— s a corner to cut.

“Buying workers’ comp for a restaurant is one of the things that many restaurant owners under-appreciate,” he said, adding that coverage is essential for everyone who works in a kitchen, even if they’re a contractor.

The National Restaurant Association forecasted in February that the restaurant industry will hit $1.1 trillion in sales in 2024. A total of 15.7 million employees work in the industry, and that number is expected to increase to 16.9 million by 2032.

More than 90% of restaurants have fewer than 50 employees, and more than 70% are single-unit operations. Seventy-six percent of operators say technology gives them a competitive edge, and nearly half of operators think using technology to help with labor challenges will become more common this year.

Was this article valuable?

Here are more articles you may enjoy.

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot