In one of the most pro-subrogation decisions in a generation, the Nevada Supreme Court has overnight turned Nevada into one of the most favorable states for workers’ compensation subrogation. With the stroke of a pen, the court in its Sept. 19 decision, has done the following:

- Abandoned the Breen Formula; which it declared was “unworkable” and “no longer good law”;

- Ruled that workers’ comp carriers no longer have to pay any portion of employees’ third-party attorneys’ fees and litigation costs;

- Confirmed the importance of a carrier intervening and participating in a third-party action;

- Acknowledged the societal and economic importance of workers’ comp subrogation and the importance of protecting it.

- Reinstated a carriers’ subrogation rights against both economic damages and non-economic damages.

- Overruled Breen v. Caesar’s Palace, 715 P.2d 1070 (Nev. 1986) and Poremba v. Southern Nevada Paving, 388 P.3d 232 (Nev. 2017).

The facts underlying this landmark decision are rather simple.

Ramon Vasquez, Jr. was working at a restaurant and slipped and fell in a puddle of liquid, injuring himself. His worker’ comp carrier, AmTrust North America Inc., paid workers’ comp benefits in the amount of $177,335.59. Vasquez files a third-party action against multiple defendants, and AmTrust intervened in the lawsuit in order to protect its statutory rights of reimbursement and subrogation on its workers’ comp lien. After nearly two years of litigation, Vasquez settled his third-party case for $400,000. Without consulting AmTrust, Vasquez and the defendants gerrymandered the settlement, allocating the $400,000 follows:

- $83,577.22 in special damages (past medical)

- $316,422.78 in general damages (non-economic damages, namely, pain and suffering).

After Vasquez’s costs and attorney fees were subtracted from the settlement amount, Vasquez was left with a “net recovery” of $193,706.71. Following the settlement, Vasquez filed a motion to adjudicate the workers’ comp lien and argued that AmTrust was entitled to none of the settlement proceeds or, at most, $83,577.82, pursuant to the Breen Formula and the Supreme Court’s 2016 decision in Poremba v. Southern Nevada Painting, 369 P.3d 357 (Nev. 2016). Even though, at the time of the settlement, AmTrust had expended over $50,000 in costs and fees in litigating the matter, the trial court held a hearing and noted that, AmTrust did not meaningfully participate in the litigation, and was therefore required to bear a portion of the litigation costs according to the Breen Formula, formula intended to allocate litigation costs and fees between the carrier and the employee, judicially-created by the long-standing Nevada Supreme Court decision in Breen v. Caesars Palace, 715 P.2d 1070 (Nev. 1986). The trial court also ruled that AmTrust could not recover anything out of the $316,422.78 portion of the settlement which was self-designated by the plaintiffs and defendants as “non-economic damages”, as a result of the judicially-created rule set forth in Poremba, which limits a workers’ comp carrier to subrogating only against “economic damages”, supposedly mirrored the sorts of economic benefits (medical and lost wages) paid in a workers’ comp claim.

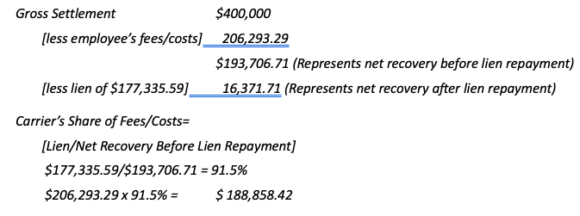

It should be noted that the trial court in Vasquez did not even perform a mathematical calculation under Breen. Instead, it just summarily announced that, notwithstanding the application of Poremba, AmTrust’s proportionate share of the litigation expenses in obtaining the settlement exceeded its lien “under any application of the Breen Formula in this matter.” However, had it actually gone to the trouble of doing the calculations, it would have determined that AmTrust’s share of costs and fees would be $188,858.42—an amount which exceeds its total lien.

The $188,858.42 figure above represents the amount AmTrust was supposed to contribute to the employee’s fees/costs; leaving it nothing.

Therefore, the trial court ordered that AmTrust recover nothing out of its statutory $177,335.59 workers’ comp lien. In fact; it owed money.

Nevada Supreme Court Decision

AmTrust appealed to the Nevada Supreme Court, which performed a very statutory, historical, and literal analysis of the statute—overturning the trial court’s ruling. It considered, from scratch, the subrogation rights of a workers’ comp carrier and made specific mention of the fact that workers’ comp serves a vital role in protecting employees and employers. It noted that the Nevada Legislature enshrined workers’ comp legislation in the early 1900s allowing injured employees to receive financial recovery for medical care as a result of their on-the-job injury without resorting to common-law tort remedies; and noted that part of this bargain was the fact that the workers’ comp carrier was granted a specific statutory interest in any third-party recover by the employee. Because of the importance of the statutory workers’ comp scheme and the legislature’s directive to refrain from applying common law principles, the Supreme Court announced it was going to shake things up a big and reconcile the obvious conflict which had developed between § 616C.215(5) and the horrible decisions in Breen and Poremba. The Supreme Court noted that the Breen Formula was created in direct conflict with the statute and “has proven unworkable.” The decision specifically overruled that decision and decreed that the Breen Formula would be abandoned in favor of a “straightforward lien analysis.”

Beginning on September 19, 2024, a workers’ comp carrier’s lien applies to all elements of damages recovered in ANY third-party recovery without any allocation of the employee’s litigation fees and costs. Beginning on September 19, 2024, a workers’ comp carrier’s lien applies to all elements of damages recovered in any third-party recovery without any allocation of the employee’s litigation fees and costs. Nevada law is clear that a decision on statutory interpretation is retroactive. Brady, Vorwerck, Ryder & Caspino v. New Albertson’s, Inc., 333 P.3d 229 (2014). Vasquez interprets a statute.

The Supreme Court also noted that Poremba was bad law. That was an understatement. The Poremba decision was a radical departure from the clear language of § 616C.215(5), which clearly provides that the carrier “has a lien upon the total proceeds of any recovery from some person other than the employer, whether the proceeds of such recovery are by way of judgment, settlement or otherwise.” Particularly troubling, not to mention confusing, in the en banc opinion is the following sloppy statement:

We agree with the Tobin court and hold that because workers’ comp insurance never compensates the injured worker for pain and suffering, an insurer is not entitled to reimbursement from any of the settlement funds that were designated for pain and suffering, or any other expense beyond the scope of workers’ comp defined in NRS 616A.090.

The Tobin v. Dept. of Labor & Industries, 187 P.3d 780 (Wash. Ct. App. 2008) decision referred to is a Washington Court of Appeals decision. This limitation on a workers’ compensation carrier’s reimbursement and subrogation rights appears to have been imported from another state, instead of following its own 1986 Supreme Court decision in Breen v. Caesars Palace, 715 P.2d 1070 (Nev. 1986) in which the court minced no words when it stated that:

The prevailing rule in the United States has been to allow an employer to reach an entire award or settlement even where the non-economic damages have been segregated and identified…In interpreting their state worker’s compensation statutes, other courts have been influenced by language in the statute permitting the employer a subrogation right in the “total” proceeds. The Arizona Supreme Court held that an insurer’s lien extended to the employee’s entire third-party recovery, including items not covered by worker’s compensation, because the statute speaks of “total recovery.”… We similarly conclude that we are bound by the statutory language which gives an insurer a subrogation interest in the “total proceeds.” It is the legislature’s prerogative, not this court’s, to correct any injustice occasioned by a literal reading of the statute. The rules of statutory construction which enabled us to liberally construe NRS 616.560 with respect to the payment of pre-malpractice medical expenses and attorney’s fees and costs are not applicable here. With respect to this issue, there is no room for statutory interpretation; the language of the statute is plain and no legislative purpose would be served by deviating from the literal language.

The Poremba decision doesn’t even contain a reference to the court’s clear ruling on this issue in Breen. However, from the date of the Vasquez decision forward, § 616C.215(5) now “mandates” that a workers’ comp carrier is entitled to collect its lien from the “total proceeds” of any third-party recovery, including any portion allocated to non-economic injuries. Both Breen and Poremba are specifically overruled and are no longer good law.

This new decision has turned Nevada workers’ comp subrogation on its ear, and transformed Nevada into one of the most favorable states in which to pursue workers’ comp subrogation claims. It is hard to believe, but Nevada was actually one of the first states to enact workers’ comp laws—back in 1913. Following some bad decisions, however, Nevada had literally become an anti-subrogation state, the cost of which was being passed on to Nevada’s small businesses as an increased cost of doing business. For years, carriers have watched their liens disintegrate and employers have seen their experience modifiers (X-mod) detrimentally affected, leading to dramatically increased workers’ comp insurance premiums—something subrogation was designed to prevent. The important thing to note here is that this amazing ruling is effective immediately. If you have any workers’ comp cases currently pending—even if you are in the process of negotiating a subrogation recovery in a third-party case—you should immediately reconsider your position in light of this new decision.

Wickert is a shareholder with Matthiesen, Wickert & Lehrer, S.C. With nearly four decades of litigation experience, he is the author of several subrogation books and legal treatises. He is licensed in both Texas and Wisconsin, and is double board-certified in both personal injury law and civil trial law by the Texas Board of Legal Specialization. He is also dual board-certified as a Civil Trial Advocate and Civil Pretrial Practice Advocate by the National Board of Trial Advocacy. Those with questions may contact Wickert at gwickert@mwl-law.com.

Was this article valuable?

Here are more articles you may enjoy.

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot  Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims