Economists nudged up quarterly U.S. economic growth projections through early next year on more sanguine views of consumer demand and maintained views that limited inflation will keep the Federal Reserve on a path toward lower borrowing costs.

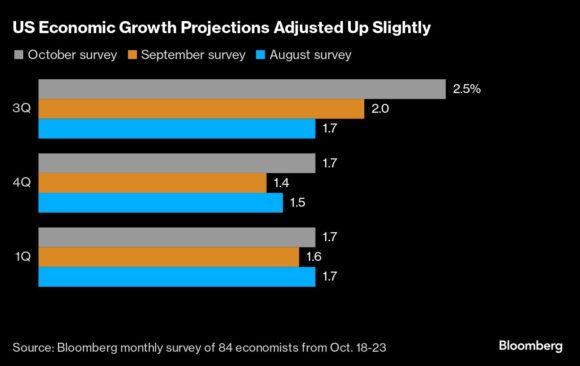

The slight upward adjustments in gross domestic product from the third quarter of 2024 through the first quarter of 2025 indicate average growth of around 2% over the period, according to the latest Bloomberg monthly survey of economists.

While the pace of economic growth in 2025 is projected to be slower relative to this year, forecasters trimmed their year-ahead recession odds to 25%. That’s the lowest reading since March 2022, and suggests the Fed will be successful in containing inflation with limited damage to the economy.

The US central bank’s preferred price gauges are seen holding close to its 2% target, allowing officials to gradually ease monetary policy and help keep the labor market from deteriorating. Economists surveyed by Bloomberg expect monthly payroll growth to average 125,000 next year — down from a monthly average of 200,000 so far this year. They see the unemployment rate averaging 4.3%, up from 4.1% currently.

“We still see the Fed lowering interest rates in November and December and in 2025 since we still see inflation in a downward channel,” said Kathy Bostjancic, chief economist at Nationwide Mutual Insurance Co.

In addition to rate cuts in November and December, economists see Fed policymakers lowering borrowing costs by another 1.25 percentage points next year.

The Bloomberg survey also pointed to consumer resilience. While household spending is still expected to moderate on a quarterly basis through the first quarter, economists boosted their estimates for growth in outlays relative to the previous survey. They were also a bit more upbeat about business investment at the start of 2025 as Washington’s political landscape becomes clearer.

“A clean result with a smooth political transition to the new president will provide clarity and help support sentiment, and in a lower interest-rate environment, it could improve economic prospects,” said James Knightley, chief international economist at ING.

Top photo: People shop at a home improvement store in Brooklyn on January 25, 2024 in New York City. Economic data from the Commerce Department released today showed that U.S. economy expanded 3.1% in 2023, shaking off inflation fears and making the U.S. the fastest growing advanced economy in the world in 2023. (Photo by Spencer Platt/Getty Images).

Was this article valuable?

Here are more articles you may enjoy.

China Executes 11 People Linked to Cyberscam Centers in Myanmar

China Executes 11 People Linked to Cyberscam Centers in Myanmar  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions