What happens when an insurance carrier, its underwriter, a broker and the insured all forget to make sure a sublimit endorsement on wind-driven rain losses is included in a multi-million dollar property policy?

In the case of a Liberty Mutual subsidiary, the underwriter was reprimanded and stripped of some authority; the broker, J. Smith Lanier & Co., was sued by the client, RPG Hospitality LLC, owner of a DoubleTree Hotel in North Carolina; and after a storm hit, the hotel company ended up tearing down part of the damaged building and undertook millions in renovations, thinking it was covered for the work.

But Liberty Mutual’s excess and surplus lines unit, Ironshore Specialty Insurance Co., won a reprieve and is off the hook for a $26 million judgment against it, thanks to a favorable Georgia Court of Appeals decision handed down last week.

“Construing this wind-driven rain endorsement to not have any applicable sublimit would essentially render the entire wind-driven rain endorsement, a provision that the parties separately signed and agreed upon, completely meaningless,” Judge Yvette Miller wrote in the June 16 opinion.

The story begins in 2017, when RPG hired J. Smith Lanier to secure a commercial policy for its upscale riverfront hotel in New Bern, North Carolina. The Georgia-based Lanier, now part of MarshMcLennan, has been called one of the largest privately held insurance brokerages in the country. It found coverage for the hotel through Liberty Mutual. The next year, Liberty Mutual acquired Ironshore, and the policy was switched to Ironshore at renewal, the court opinion explained.

The policy limits were for $26.2 million with a $250,000 sub-limit on wind-driven rain damage, according to the quote. RPG agreed to the terms and the broker accepted the policy on RPG’s behalf.

The policy’s section on wind-driven rain stated: “Subject to the terms and conditions of the policy and the applicable sublimit of liability, this policy provides coverage for direct physical loss or damage to the interior of any building or structure, or the property inside the building or structure caused by wind-driven rain.”

The problem was that the actual sublimit endorsement document was never included in the policy binder provided to the hotel company.

“Ironshore’s underwriter could not remember whether he had reviewed the policy at the time it was issued, he could not recall asking any other individual to review it, and no one else at Ironshore apparently reviewed the policy,” Judge Miller wrote.

RPG, J. Smith Lanier, and R-T Specialty, a wholesale distributor, all reviewed the policy around the time it was issued, but none of them seemed to notice the omission. In June 2018, an audit by Ironshore’s senior vice president discovered that the sublimit documents were missing from the policy. But the carrier did not inform RPG and instead focused on “getting it right” in the future, the court noted.

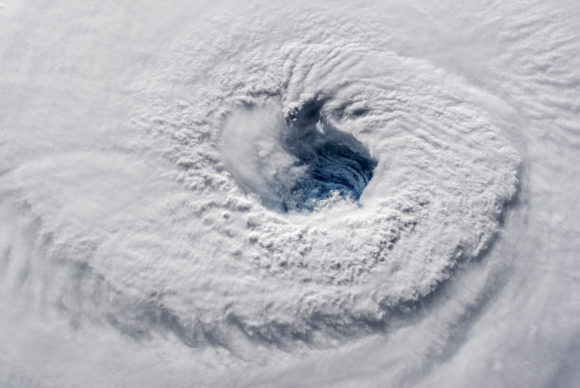

Three months later, Hurricane Florence slammed the North Carolina coast as a Category 4 storm, causing an estimated $24 billion in damage to the region and significant losses to the hotel property. An Ironshore adjuster visited the hotel and witnessed the repair work that was already underway. The insurer went so far as to approve the demolition of parts of the hotel, along with extensive mitigation work that cost millions of dollars, the court explained.

RPG’s own adjuster was the one that explained to the hospitality firm that the policy was missing certain documents. And a week after the storm, Ironshore finally sent some of those documents – but still not the sublimit endorsement. Three weeks later, Ironshore attempted to add a sublimit.

RPG officials refused to accept it. Ironshore refused to accept any further claims on the Double Tree Hotel property.

Both sides went to court.

in 2018. (AP Photo/Steve Helber, File)

The trial judge in Georgia concluded that the policy provided up to its limits, $26.2 million, because it did not include any sublimit endorsement. The judge also ruled against Ironshore’s contention that it should be allowed to re-do the policy with the endorsement.

But the appellate court found some wiggle room for the insurance company. Georgia’s rules of contract interpretation require the court to look at the circumstances and the “contract in whole”: The RPG policy clearly references the sublimit endorsement, along with the statement that the most Ironshore would pay for wind-driven rain is the sublimit. Without that, the policy is “manifestly incomplete,” the judges said.

Citing a 2002 appeals court decision, the judge wrote that the test is not what the insurer intended its words to mean, but rather what a reasonable person in the insured’s position would understand them to mean. It also allowed non-contract, or verbal evidence to support Ironshore’s argument that all sides intended for there to be a sublimit.

In the end, the court found that the facts of the case were in dispute and reversed the $26 million judgment against Ironshore. But the court also upheld the trial judge’s dismissal of Ironshore’s request to reform the policy with the complete endorsement documentation.

It’s unknown if the hotel company will seek a further appeal to the Georgia Supreme Court. Attorneys for RPG, Chris Cosper and Jordan Bell of the Hull Barrett law firm in Georgia, could not be reached for comment Monday.

Top photo: In this Sept. 12, 2018 photo provided by NASA, Hurricane Florence churns over the Atlantic Ocean heading for the U.S. east coast as seen from the International Space Station. Astronaut Alexander Gerst, who shot the photo, tweeted: “Ever stared down the gaping eye of a category 4 hurricane? It’s chilling, even from space.” (Alexander Gerst/ESA/NASA via AP)

Was this article valuable?

Here are more articles you may enjoy.

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads