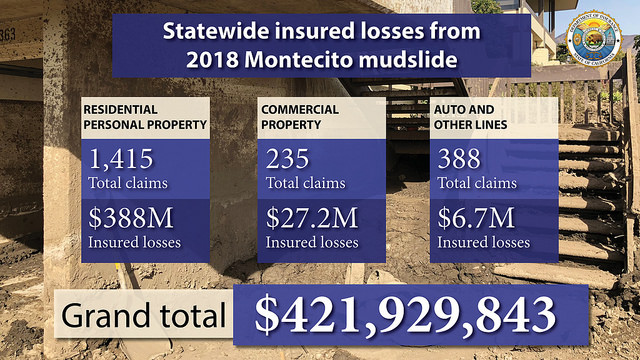

Insurers have received over 2,000 insurance claims totaling more than $421 million in losses from the deadly Montecito, Calif., mudslide that roared through the community carrying tons of mud and debris destroying or damaging more than 400 homes and businesses, and tragically killing 21 people.

“Over $421 million in insured losses represents more than property lost—behind these numbers are the tragic deaths of 21 people and thousands of residents traumatized by unfathomable loss,” said Insurance Commissioner Dave Jones. “Recovering and rebuilding lives, homes and neighborhoods will take time—and it will be difficult. We will continue to do all we can at the Department of Insurance to help residents navigate the claims process and recover.”

Commissioner Jones’ issued a formal notice to all property/casualty insurance carriers urging them to cover damages from the recent mudslides and debris flows if it is determined that the destruction of the hillsides and vegetation by the Thomas and other fires was the efficient proximate cause of the mudslides. Jones also stated in his notice that there is substantial evidence that the fires were the efficient proximate cause of the mudslides.

Insurers responded to a insurance department-issued questionnaire indicating they are processing claims under the proximate cause doctrine. The department has not received reports of any denials of these claims due to exclusion for mudslides.

Commissioner Jones also held an Insurance Claim Workshop in Santa Barbara for survivors to ensure they are aware of the resources available during the rebuilding and recovery process. Residents had the opportunity to meet one-on-one with department representatives to address specific insurance needs. Jones also deployed department staff to assist affected consumers at town halls meetings and local assistance and disaster centers in Santa Barbara.

Source: California Department of Insurance

Was this article valuable?

Here are more articles you may enjoy.

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  Berkshire Utility Presses Wildfire Appeal With Billions at Stake

Berkshire Utility Presses Wildfire Appeal With Billions at Stake  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot