Courts are split on whether an excess insurer can sue the primary insurer’s defense counsel for legal malpractice. There are...

Steve Plitt News

Before the duty to defend arises, three conditions must be met: (1) it must be established that the policy contains...

Coverage questions arise in automobile liability where family members, as additional insureds, are living apart from the household of the...

The Florida Legislature has statutorily prohibited public adjusters from contacting loss victims within 48 hours following the loss. The state...

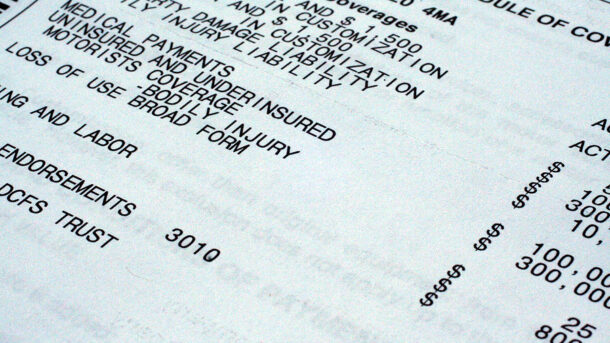

Most automobile and premises liability policies provide medical payments coverage. The amount of available coverage is typically small and therefore...

When an insurance company defends its insured under a reservation of rights, the question arises as to whether the insurer...

Insurance companies may negotiate with their policyholder a settlement of a coverage dispute through a coverage buyback agreement. In this...