Insurance carriers spend approximately $190 million a year on inspection programs, yet 75 percent of inspections done today offer no immediate value to loss experience or a carrier’s bottom line, according to a claims firm.

The problem with inspection efficacy isn’t the quality of the report; instead, it’s the old way of thinking, said Steven Brewer, senior vice president of underwriting solutions at Marshall & Swift/Boeckh (MSB). “The carriers are getting very consistent information from the inspection process. The problem is they are getting consistent information on the wrong risks or risks that don’t pose a high risk, he said.

There are a number of different reasons an insurance carrier will order an inspection, according to Brewer. “In some cases they will want the data to be verified for the risk that they are insuring. [The company] may be looking for condition hazards or other factors that may yield risk or a likelihood of a loss.”

Most underwriting departments have criteria they use to determine if a policy is an acceptable risk. “There are two classifications of criteria: One is whether the properly is insured to value. The second are risk factors; a multi-peril policy can cover a lot of different type of losses. And so the carriers like to put eyes on a property to confirm that those conditions do not exist or if they do exist, give an insured an opportunity to mitigate the issues,” Brewer said.

According to Brewer, carriers want to ensure proper coverage is set along the guidelines of the policy.

“A lot of carriers will look for conditions that they know can yield a higher propensity for a loss, such as attractive nuisances like an unfenced pool. General conditions that may be high risk factors or that may be excluded under a certain policy condition.”

Carriers are ordering inspections on homes that aren’t the highest risk homes in their portfolio. “Historical inspection guidelines would say go inspect a home over this value or over this age. That’s not always the best correlation to the actual homes that are the highest risk,” he said.

Rather, carriers need to consider updating inspection guidelines to suit their company needs.

“What we find is that a lot of inspections ordered don’t actually yield a result that is actionable to the carrier,” Brewer said. “So they may go out and they may take photos of the property and they may calculate the replacement value and they may find there is nothing notable that is a risk factor and that the insurance is properly set for that risk.”

According to Brewer, at an estimated cost of $25 to $35 dollars per inspection, carriers aren’t getting information that would help them mitigate future loss. “I wouldn’t say they are not valuable, but if you could have a predictive model that could identify where your areas of highest risk are, you would certainly want to use a method of inspection to go after those first and right now that is really not prevalent in the industry,” he said.

Predictive Analytics Optimize Inspections

In order to optimize the inspection process, Brewer recommended carriers reexamine the criteria used in requesting inspection reports. This is necessary not only to improve a carrier’s bottom line but also to remain competitive within the marketplace.

“Carriers are moving to compete on information. Carriers who can use better risk indicators to more effectively utilize risk management and inspection dollars are going to find the actionable issues and they will be able to take a better risk management approach to their book,” Brewer said.

Understanding what is driving a condition hazard equates to a better understanding of current risk indicators, according to Brewer. “Not only identifying the risks to be reviewed, but also the right method to review them.”

MSB reviewed close to five million inspections for its carrier clients. What MSB found allowed the company to make a concerted effort to aggregate new risk predictors.

“New risk predictive data, such as foreclosure information and home vacancy rates, are emerging as predictive of when a home or a person may modify or maintain their homes differently,” Brewer said. “This new predictive modeling of data not previously available to carriers gives a new perspective on which homes they may not be looking at historically, but may be a high risk within their portfolio.”

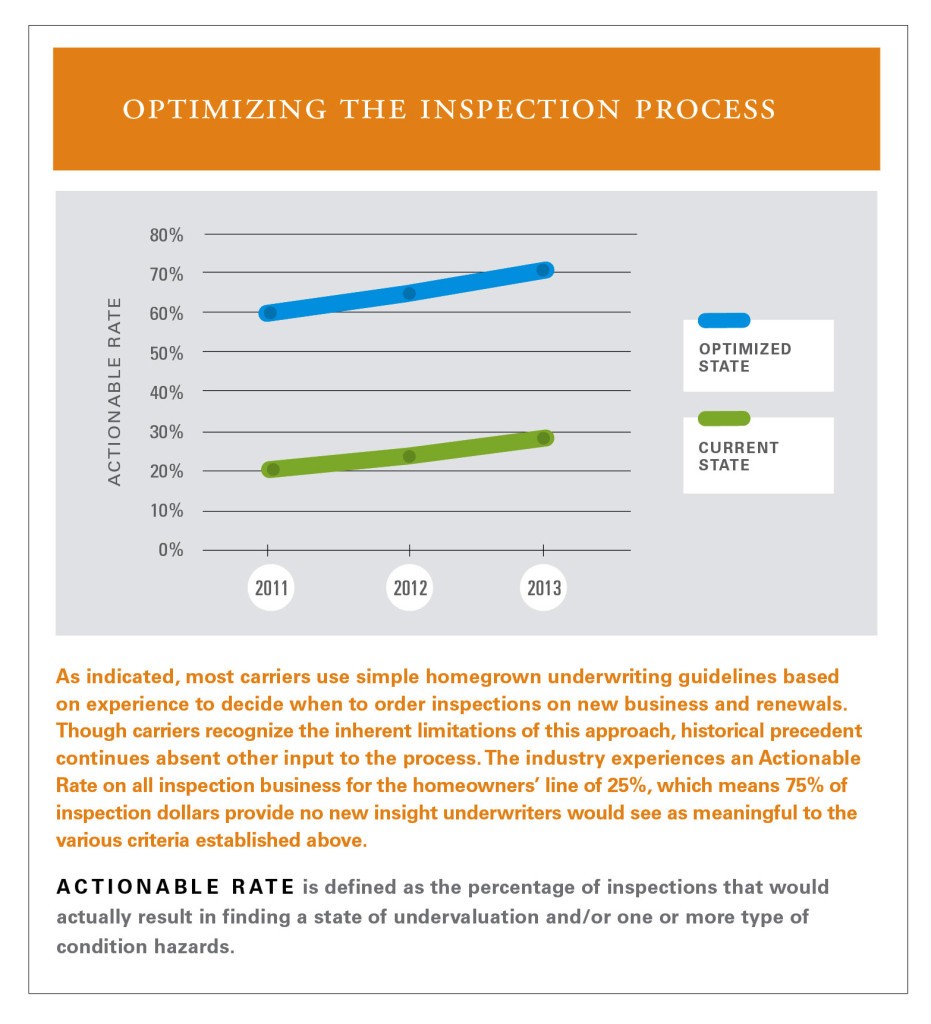

MSB’s predictive modeling efforts involve aligning the type of coverage a carrier writes and the risk variables the carrier indemnifies to each carrier’s desired outcome. The current inspection actionable rate is 20-30 percent, while MSB’s proprietary predictive model generates client carriers a 60-70 percent actionable rate, according to Brewer.

Was this article valuable?

Here are more articles you may enjoy.

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand