Professional meteorology, as it relates to insurance claims handling and the litigation process, is becoming increasingly recognized, and the employment of meteorologists within the insurance industry is growing. But what does meteorology have to do with storm damage insurance claims?

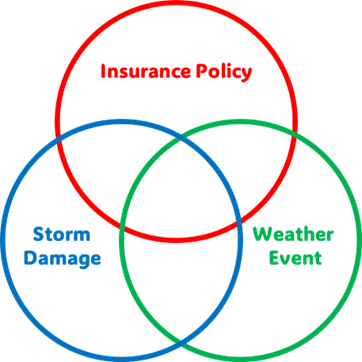

A simple Venn diagram (below) can explain the key, but often overlooked, reason: storms that are claimed matter.

Ultimately, there are three main facts that must apply for a storm damage insurance claim:

- An insurance policy.

- Storm damage.

- A damaging storm.

Simply put, no two factors for a storm damage insurance claim alone provide a full picture of insurance carrier liability when considering coverage for a storm damage insurance claim. A storm must result in covered damage during an applicable insurance policy coverage period.

Forensic Meteorologists

Meteorologists are not tasked with considering policy coverage or identifying the claimed damages; rather, they assist clients in determining the weather events that may or may not apply to the policy for the claimed loss.

Most meteorologists are not damage experts, nor do they testify to the causation or nature of claimed damages. However, sometimes a distinct correlation between claimed damages and severe weather can be drawn, such as the path of a tornado, or a significant flooding and/or storm surge event.

Likewise, insurance adjusters are policy experts, appraisers are appraisal experts, and building consultants, architects, and engineers are damage experts. While it is important that these professionals correlate weather events to claimed damages and insurance policies, the best source of weather information and expertise is a weather expert—a meteorologist.

Despite the rising popularity of enlisting the help of meteorology experts in insurance claims and litigation, one of the most common reasons meteorologists are not retained is because of the perception that “the damage (or lack thereof) speaks for itself.” No doubt, if both parties agree on everything related to the claim, then this is a reasonable assertion.

However, when the damage and/or policy application (including appraised value) is disputed by involved parties, the third circle of the insurance claim Venn diagram (the weather event) can provide vital evidence that ultimately supports or conflicts with certain facts of the insurance claim as presented.

Consider the following frequent scenarios:

- Damage is claimed and disputed. One party indicates that the damage is a result of a windstorm, while the other party indicates that the structure is old and has been subjected to normal wear and tear. Certainly, the matter of whether, and when, a windstorm occurred (and the caliber of which it occurred) will be pivotal in determining coverage for this claim.

- Severe hail damage is claimed. Both parties agree that there is severe hail damage. Both parties agree that the severe hail damage is recent. Both parties agree that the current insurance policy covers hail damage. However, the current insurance carrier is new to the property, and despite the recent hail damage, the insurance carrier may not have been the carrier when the damage occurred. Therefore, even though the damage is not disputed and is clearly an otherwise “covered peril,” the determination of policy application will be almost, if not completely, determined based on the exact date of the severe hailstorm occurrence.

- Heavy rain and flooding damage is claimed and is undisputed. It occurs at an insured property, and insurance coverage is not in dispute. However, there is a question as to the number of rain events, and, therefore, the number of deductibles that apply. Meteorological expertise will be needed to determine the number of rain events in question.

- A hurricane occurs, bringing storm surge, heavy rain, and fierce winds. A property is substantially damaged by water intrusion, and this is undisputed. It is also undisputed that the damage was caused during the hurricane, and that an active insurance policy was in effect. However, the cause of the water intrusion is in dispute (i.e., a wind-created opening, or flood?). In this case, damage experts will provide opinions regarding causation, but the caliber (and possibly timing) of the winds, heavy rain, and storm surge should be considered as possible contributing factors.

- Storm damage is claimed and disputed. One party indicates that the damage occurred due to a hail and wind event on a particular date, citing an automated weather report. The other party responds with a different automated weather report indicating no hail and wind event on the date claimed, contradicting the first party’s automated weather report. Clearly, an honest, reliable weather opinion by a meteorology expert is needed to resolve this debate.

- Storm damage is claimed and is undisputed. The storm which caused the damage occurred at an insured property, and it is undisputed that the peril experienced is ultimately covered by the insurance policy. However, there is a different deductible depending on whether the storm was considered “severe” by a “governing meteorological authority.” In this case, an interpretation of the storm event by a meteorologist should be provided to the insurance adjuster for application to the policy.

These instances are just a few of many where a credentialed forensic meteorologist can assist in the insurance claims and litigation process. These examples also demonstrate the incredible synergy between insurance adjusters and appraisers, damage experts, and meteorologists.

In some of the most contentious insurance claims in which forensic meteorologists are retained, the damage itself is very much disputed, and, therefore, the application of the policy hangs in limbo, as does the potential financial liability. However, once weather experts are retained to provide scientifically accurate weather opinions, these insurance claims often result in a timely and agreeable resolution.

If you or your organization are engaged in a storm damage claim at risk of becoming stalled, prolonged, or otherwise complicated due to a dispute regarding the facts of a weather event or storm, be sure to enlist the help of expert forensic meteorologists early in the process to avoid or reduce unnecessary additional resolution time or costs.

Schreiber is a senior vice president in J.S. Held’s forensic meteorology service line. He is a certified consulting meteorologist with more than 10 years of experience in military, aviation and severe weather operations. Email: daniel.schreiber@jsheld.com; Phone: (830) 453-0255.

Was this article valuable?

Here are more articles you may enjoy.

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud

Charges Dropped Against ‘Poster Boy’ Contractor Accused of Insurance Fraud  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot  LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims