Although Mercury Insurance Group expects gross losses from the 2025 California wildfires in the $1.6 billion-$2.0 billion range, potential subrogation and reinsurance recoveries will drop the ultimate bill down to $325 million or less, the company believes.

“We believe there is strong video and other evidence that shows utility equipment caused the Eaton fire,” said Ted Stalick, senior vice president and chief financial officer, during an earnings conference call.

Related articles: Southern California Edison Probes Possible Link to Los Angeles Fires; Edison Utility Faces Shareholder Lawsuit Over LA Wildfires

Based on subrogation recoveries from 15 past wildfire events, Mercury executives estimate the range of recoveries from the Eaton fire to fall in the 40-70% range.

“With our subrogation potential, I think the likelihood of us classifying this as two events is less likely,” said Chief Executive Officer Gabriel Tirador, responding to a question about whether the largest fires—the Eaton and Palisades fires—would be considered one or two events for the purposes of reinsurance recoveries. “It’s an option, and I believe that we’ll probably make a decision on that relatively soon,” he added.

Related articles: Mercury General Gives Reinsurance Update: One or Two Events Still TBD; Mercury General Wildfire Losses Will Hit Reinsurance Cover. One Event?

In late January, Mercury first addressed the question of whether the fires would be considered one or two events, noting that under a two-event scenario, Mercury General can elect to use reinsurance limits of up to $1,290 million for the first event and reinstated limits up to $1,238 million for the second event. In this scenario, Mercury would be responsible for the first and second event retentions of $150 million each, and up to a $101 million reinstatement premium.

At the time of the January announcement, Mercury said the election remained an open question, and during the earnings conference executives updated this, repeatedly saying that subrogation recovery potential from the Eaton fire made the two-event election much less likely.

“There is active interest in purchasing the company’s subrogation rights,” Stalick reported.

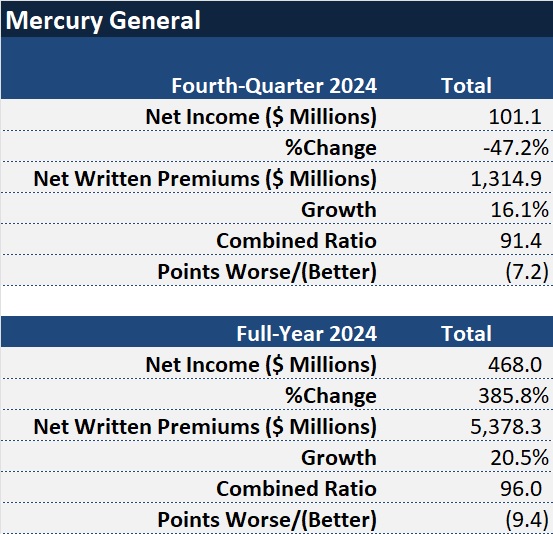

Executives led off the conference call reporting that the insurance company had broken multiple financial records with fourth-quarter operating income of $154 million and full-year operating income of $398 million, marking the highest figures in the company’s history.

Net written premium growth of 20.5% for the full year was the highest increase since 2003, Tirador said, also noting that the combination of rate increases and moderating inflation helped drive the fourth-quarter combined ratio more than seven points to 91.4.

The full-year combined ratio improved 9.4 points compared to 2023, coming in at 96 for 2024 in spite of the fact that the 2024 combined ratio included 5.5 points of catastrophe losses.

Year-end statutory surplus of over $2.0 billion was also the highest in the history of the company.

Looking forward, Tirador said that continued underlying earnings momentum is expected to provide enough capital generation to build back any capital erosion from the January wildfires.

After reinsurance and subrogation recoveries, but excluding Mercury’s share of FAIR Plan losses, net ultimate losses from the wildfires will range from $155 million to $325 million before taxes, the company said. After taxes, the net hit to statutory surplus could be $165 million to $295 million, Tirador said.

Stock market reaction to news of the record earnings at the publicly traded company and the potential for subrogation and reinsurance recoveries to shave 80-plus percent off the total wildfire loss bill was initially positive. The stock showed the largest upward movement of any P/C insurance company that Carrier Management follows, opening 20% higher on the morning after the news crossed the wires. The stock price momentum started to wane later in the day with more than 60% of the gain erased by the end of trading on the day of earnings call. During the call, several investors challenged executives on the assumptions used to peg ultimate losses. One worried about the exclusion of Mercury’s share of FAIR Plan losses from loss estimates and another questioned the fact that part of the estimation process relied on payout ratios from past wildfire events.

Executives patiently laid out specifics of the estimates of gross losses several times to calm those individual investors, with Stalick explaining that Mercury starts with a tally of known total losses, which are identified through policyholder reports, on-ground inspections and aerial imagery.

“We know what the total insured value is for each one of the total losses,” the CFO said, listing dwelling limits, additional replacement costs, contents limits, debris removal, additional structures, plants and landscaping, additional living expenses as components of those total losses.

“We then have previous major wildfire events,…and we know what percentage of the TIV we actually ultimately paid out on those events…So, we can just take the TIV from the totals that we know today, apply those percentages from previous very large wildfire events on total, and that gives us a pretty reasonable estimate of what the ultimate loss will be on the totals,” he said, still referring to claims for total losses.

Partial losses come in over time, he stated, referring to smoke damage, evacuation costs, and structural damage to fences or detached garages. “We know what’s been reported to date. We know typically the tail on the reporting pattern based on other very large events, and we have an idea of what the average severities are on those based on other historical information and current information,” he said, explaining the process for tallying partial losses.

“The dollars from the total losses are by far the largest component of the ultimate loss for the company,” he said.

As for the FAIR Plan, Tirador referred to Tuesday’s announcement from the California Department of Insurance stating that CDI had approved the FAIR Plan’s request for a $1 billion industry assessment. Since Mercury’s participation rate in the FAIR Plan is roughly 5%, the executives said they expect a $50 million assessment but stressed that 50% of that can be recouped via a temporary supplemental fee to policyholders.

“Anything above $1 billion, we can recoup 100%,” Tirador added.

“But that cash goes [right] out the door, [and] you’re going to have to charge your clients more over [time],” an investor argued, worried that Mercury has an “immediate need for capital.”

“We don’t have any liquidity issues,” Tirador said.

Addressing the liquidity question earlier during his opening remarks, Stalick reported that the company has over $1 billion cash on hand and the cash is earning 4.35% at current bank rates.

Adding to Tirador’s response to the investor who worried that FAIR Plan losses could mount to $10 billion or $20 billion, Stalick noted that Mercury’s reinsurance treaties allow for the inclusion of FAIR Plan losses.

Related articles: LA Fires: Calif. Insurance Commissioner OKs FAIR Plan Request for $1B Assessment; Will California’s FAIR Plan Have Enough Cash for Its Wildfire Claims?

“So, to the extent that we have [one] of these worst-case FAIR Plan scenarios, which by the way probably don’t take into consideration that the FAIR Plan has their own reinsurance, …we can attach the FAIR Plan losses to our reinsurance treaty, which we’ve done actually in previous massive wildfires. And on top of that, with these assessments, we’re able to surcharge our policyholders to recoup the assessments,” he said, explaining why executives bifurcated the discussion of Mercury’s losses and FAIR Plan losses. “We think that that’s separate and it’s something that is not going to be as significant to the company,” he said.

Summing up Mercury’s claim activity to date, Stalick reported that the company has already paid out $800 million to its insureds, primarily for 100% of Coverage A dwelling limits, as well as advances up to 250,000 on contents losses and advances for additional living expenses.

“We have billed $611 million to our reinsurers and have received back, actually as of this morning, $531 million to date,” he said on Wednesday.

Later, President and Chief Operating Officer Victor Joseph provided more detail, noting that 2,700 claims have been reported to Mercury from the Eaton and Palisades fires—roughly 650 from homeowners policies that are total losses, and 150 “totals” for landlord, renters, condos, and commercial property policies.

Top photo: 2025 Palisades Fire. Source: CalFire.

Was this article valuable?

Here are more articles you may enjoy.

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case  Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand