While Western wildfires have dominated disaster news for decades, new analysis using artificial intelligence shows millions of homes across the country—even in the swampy Southeast—are at risk for wildfires.

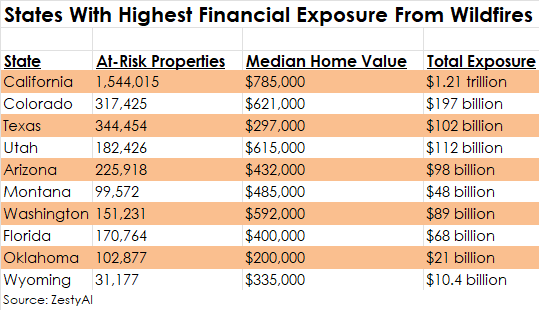

New data analysis from ZestyAI found that $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage. The study assessed 126 million properties nationwide and found 4.3 million individual homes face heightened wildfire risk.

Related: Thousands of Homes Face ‘Triple Threat’ Risks, CoreLogic Says

“Wildfires are threatening more properties than ever before, with billions of dollars in exposure even in areas many people don’t associate with fire risk,” Attila Toth, founder and CEO of ZestyAI.

The study used AI models trained on over 2,000 past wildfires and mapped exposure at the property level, integrating satellite and aerial imagery, topography and structure-specific characteristics.

Related: Fire Danger in LA Is All Around, But Signals to Residents Are Mixed

The report found growing development abutting wild lands and intensifying climate conditions are driving higher wildfire risk in states like North Carolina (4.6% of homes at high risk), Kentucky (2.9%), Tennessee (2.3%) and even South Dakota (11.0%).

Unsurprisingly, California has the highest total exposure for wildfire damage, with over 1.54 million homes and $1.21 trillion in total exposure. California was followed by Colorado, Texas, Utah and Arizona.

Because many areas are not historically prone to wildfires, homeowners may be unaware of risks and underinsured, Toth said. One in eight U.S. homeowners already lacks adequate insurance coverage.

On the other hand, Toth said, “Insurers have traditionally relied on broad, regional models that don’t account for individual property characteristics. That means some homeowners are denied coverage even when their true risk is much lower than their neighbors’.”

Related: Insurers Have Now Paid Out Nearly $7B for LA Wildfires, Report Shows

Toth said that AI-driven risk analytics can mean more accurate and efficient assessments of wildfire exposure. Granular, property-specific insights can help insurers make smarter underwriting decisions—keeping coverage available in high-risk areas while ensuring that homeowners who take mitigation steps are recognized.

Top photo: The Palisades Fire in Los Angeles, January 2025. Source: CalFire.

Was this article valuable?

Here are more articles you may enjoy.

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand