Property-catastrophe capacity remained adequate to meet demand during the April 1 renewals for U.S. reinsurance buyers, despite the record losses from California’s January wildfires, according to Aon and Gallagher Re in their renewal reports.

Reinsurers continued to demonstrate an appetite for growth for U.S. property-cat exposures during the April renewals, while alternative capital markets provided healthy competition and new start-up reinsurers looked for growth opportunities, Aon said in its report, titled Reinsurance Market Dynamics – April 2025 Renewal.”

The California wildfire losses have not led to a market-wide change in reinsurer appetite or pricing, said Aon, noting that reinsurance capital continues to grow and keep pace with increasing demand.

Related: Buyer-Friendly April Reinsurance Renewal Bodes Well for Mid-Year Renewals: Brokers

Aon acknowledged that the Los Angeles wildfires (expected to cost the re/insurance industry between $32 billion and $38 billion) had mixed results for the relatively small and diverse group of U.S. regional and national insurers that renewed at 4/1 – based on their exposures and loss experience. (The wildfires also had little to no impact on reinsurance capacity, pricing and terms for buyers in Asia Pacific, the region that dominates the 4/1 renewals, Aon said).

“Reinsurers continued to trade and deploy capacity uninterrupted, with continuing support for insurers with significant wildfire exposure. Some reinsurers stepped up to offer additional wildfire capacity and were rewarded with larger signings,” Aon said, adding that the majority of reinsurers responded “outstandingly” to the LA wildfires, which will like rank among the top three costliest wildfires in U.S. history.

“Property-catastrophe capacity remained ample despite the wildfires, with buyers taking advantage of this increase in supply to hold retention levels constant, and push price reductions at the top end of programs,” according to Gallagher Re in its report, titled “1st View – Finding the Path.”

“Impacted renewals were limited in number, and specific outcomes were dependent on buyer loss experience and program size,” Gallagher said.

“The Los Angeles wildfires tempered reductions and led to more conservative quoting at 4/1, although the impact was largely localized. Loss-free accounts achieved risk-adjusted rate reductions in line with January 1, while loss-impacted accounts typically experienced stable conditions,” according to Aon.

“Terms and conditions around wildfire were a key topic of discussion with reinsurers as each insurer determined with their trading partners the most effective path forward for their portfolio exposure,” Aon said.

And there were growth opportunities related to wildfire exposures, Aon indicated, saying that reinsurers were rewarded with increased participation on programs at 4/1 if they took the opportunity to increase capacity and lean-in to wildfire risk.

Impact on Catastrophe Budgets?

In a report on the four largest European reinsurers – Munich Re, Swiss Re, Hannover Re and SCOR – Moody’s Ratings said the LA wildfire losses have already absorbed around 39% of their combined annual catastrophe budgets. “This will make it harder for the companies to remain within their budgets for 2025, as catastrophe claims typically do not peak until the US hurricane season gets underway during the third quarter.”

The LA wildfire claims of an estimated $30 billion-$50 billion are akin to a large hurricane, and will dent reinsurers’ annual catastrophe claims budget, Moody’s added in its report, titled “Reinsurers’ earnings prospects favorable after record 2024 results,” which was published on April 1.

However, Moody’s said the earnings prospects for the four reinsurers remain strong despite the sizable wildfire claims, helped by persistently strong demand for both property/casualty and life & health reinsurance along with robust investment returns.

Three of the four reinsurers — Hannover Re, Munich Re and Swiss Re — have raised their net income targets by over 20%, Moody’s said, noting that their earnings performance will ultimately depend on whether there are further significant catastrophe losses during the remainder of the year.

While the California wildfire losses are indeed substantial, Gallagher said, claims remain manageable and sit within reinsurers’ 2025 natural catastrophe budgets.

Gallagher explained that there was some market sensitivity about “the degree to which wildfire losses have eroded remaining catastrophe budgets so early in the year – with the traditionally higher cat loss quarters still to come.”

Aon said that 2025 is likely to see the highest first quarter loss from natural catastrophes in more than a decade as a result of the Los Angeles wildfires.

While ceded losses from the wildfires are significant – at an estimated $11 billion to $17 billion – the impact on individual reinsurers will vary, Aon continued. “These losses have absorbed 25% to 33% of major reinsurers’ annual catastrophe allowances which may affect how some come to the market at mid-year.”

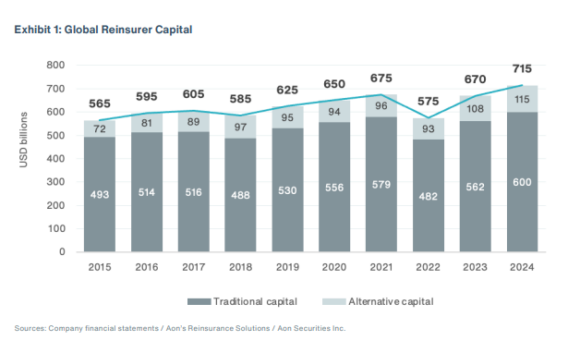

However, global reinsurers’ fundamentals remain strong – reporting excellent results in 2023 and 2024, which helped grow traditional reinsurance capital to an all-time high of $655 billion with overall capital rising by 5.3% to $769 billion, Gallagher said. (The broker’s overall capital figure includes traditional reinsurance capital and alternative capital of $114 billion).

Favorable Market Conditions Ahead

“Despite an active first quarter for catastrophe losses, we expect the favorable conditions seen at January and April renewals to continue at mid-year, supported by the weight of reinsurance capacity and unfulfilled reinsurer appetite,” Aon confirmed.

“[T]he reinsurance market is highly capitalized and competitive ahead of midyear renewals. With pent-up supply still outstripping demand, the mid-year represents the last major renewal opportunity for reinsurers to meet 2025 growth targets and earn premium to offset losses in the first quarter,” Aon noted.

Photograph: Louise Hamlin visits her home ravaged by the Eaton Fire in Altadena, California on Thursday, Jan. 30, 2025. (AP Photo/Jae C. Hong, File)

Was this article valuable?

Here are more articles you may enjoy.

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk