One year ago, three independent claims adjusters stood before the Florida House Commerce Committee and charged that several insurance companies had frequently and misleadingly altered their damage estimates on wind claims.

The chairman of that committee said the men’s allegations could amount to fraud by insurers, and it should be investigated by state authorities.

This week, two of those adjusters said they’ve never heard from anyone with the Florida Department of Financial Services, despite providing the agency with hundreds of pages of evidence. They now are demanding that the investigators be fired for lack of effort.

“We handed them every bit of evidence they needed. They could have gone through it all in a day – or a week at the most if they’re really slow,” said Ben Mandell, who has worked on a contract basis for insurance companies for several years.

“They are trying to/did kill the investigation,” Mark Vinson, another independent adjuster who spoke at the committee hearing, said in a text.

A response from DFS on the issue has been limited. The department, which oversees insurance fraud investigations, has provided differing accounts over the past several months. In February, a DFS spokesman said the investigation had been closed due to lack of cooperation from the adjusters, something Mandell and Vinson have strongly disputed. The department also said it had turned the case over to the Florida Office of Insurance Regulation to study for potential market conduct violations by the insurance companies.

This week, DFS officials declined to sit down for an interview with Insurance Journal. But DFS communications director, Devin Galetta, said in a statement that multiple allegations, from the adjusters and others, including a contractor, are now under investigation. Only one examination had been closed due to lack of cooperation. He did not provide further information on that case.

Galetta also said this week that a state prosecutor had issued a subpoena “in this case,” but it was dropped after a witness did not comply. He did not provide a copy of the subpoena or explain why the person being subpoenaed was not prosecuted for contempt of court.

Mandell said the contention that the adjusters had been contacted or subpoenaed by anyone was “absolutely a lie.”

“They’re trying to bamboozle everybody,” Mandell said.

Others agree. Doug Quinn, executive director of the American Policyholders Association, an advocacy group, said early this year that a captain with the DFS investigative division told him that it should take only about six months to complete the investigation. DFS has not provided the name of the lead investigator. Investigators did not return phone calls this week from Insurance Journal.

Florida Insurance Commissioner Michael Yaworsky did agree to an interview. He said that the adjusters’ allegations may very well be part of a market conduct examination by his office, but that those reports can take more than two years to complete.

Examiners “have to go line-by-line to identify if there is a pattern or practice,” Yaworsky said.

But he acknowledged that he’s heard little about any investigation into the adjusters’ claims. State agencies, in general, appear to be ready to hold insurers accountable and to make sure they pay legitimate claims after Hurricane Ian hit the state in September 2022, he said.

“But the bottom line is we haven’t seen much energy around this issue – these particular adjusters’ allegations,” Yaworsky said.

Florida lawmakers approved Senate Bill 7052, the Insurer Accountability Act, this spring after the adjusters made their accusations. The law bars carriers from changing field adjusters’ reports without fully explaining the changes to policyholders. And the law quintupled the financial penalties for some market conduct violations, Yaworsky pointed out.

Lawmakers also granted OIR funding for 29 additional positions, which should help significantly with scrutinizing insurers’ behavior, he said.

The adjusters argue that much more needs to be done: Insurance company officials need to be prosecuted to deter similar behavior. They feel that the apparent delays are inexplicable: Some Other DFS investigations, of contractors accused of fraud, for example, have been completed in seven months.

Although some insurers have improved their claims-handling behavior and have stopped altering their independent field adjusters’ damage reports, others have not, Mandell and others have told Insurance Journal. One company has instructed field adjusters to leave off dollar amounts on computerized estimates, a move that could make it easier for desk adjusters to reduce the amount of damages, he said.

“A lot of people just can’t collect on legitimate claims now,” Mandell argued.

The adjusters have declined to publicly name the insurance companies and their claims-management firms that may have altered field inspections while keeping the independent adjusters’ names on the reports, citing potential civil litigation. But the adjusters have provided redacted documents, comparing field estimates to insurers’ revised reports that were sent to insureds.

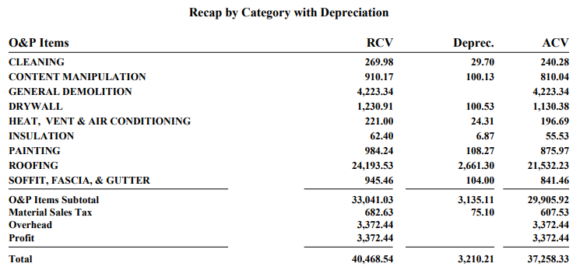

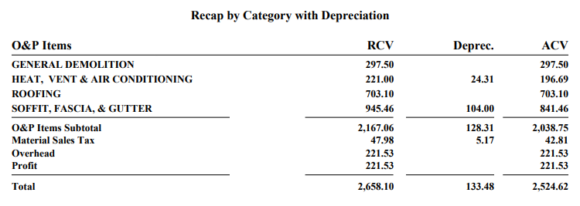

In one example, Mandell’s Oct. 2022 estimate for a Hurricane Ian-damaged home was $40,468 – for roof repair, demolition work, drywall repair, cleaning, and other work. The final altered estimate, sent by the insurer to the homeowner, was for $2,658.

The insurer had reduced the roof damage by 97%. Several categories on the original estimate were removed altogether, including cleaning, drywall, and painting. Demolition cost was reduced by almost $4,000.

The final estimate, sent to the insured, was formatted much like Mandell’s original, and it kept his name on it without providing the homeowner with the original report. The adjuster said that makes it appear that he had arrived at the much smaller damage estimate after physical inspection, a misrepresentation that amounts to fraud by the carrier, he argued.

To be sure, photographs that Mandell took of the damage and included in his report, which were examined by Insurance Journal, do not seem to reveal extensive injury to the structure. The shots show a small number of roof shingles missing altogether. Multiple close-ups of roof shingles show what, to the untrained eye, appears to be relatively minor indentations. Granules are missing from some spots, exposing the fiberglass matting inside the shingles.

Mandell said that is evidence of wind-borne debris or other wind damage. If most of the roof is not replaced, “it will start leaking in three to six months,” he said.

Other photos in his report, of purported damage to ceilings from water leaks, appear to show very little discoloration to the drywall.

A few Florida insurance insiders and advocates have pushed back against the adjusters’ allegations over the past year. Some have tried to discredit the men and dig up dirt on them. Mandell and Vinson have been quick to note that they are not hostile to the industry and are, in fact, biting the hand that feeds: Most of their work comes from insurance companies that hire them on a contract basis. They are freelancers, not public adjusters.

And Mandell said that his assignments from one carrier have dropped sharply since he went public.

Still, the men said they can’t sit by if their work product is manipulated in a misleading manner.

Others in the insurance industry have said the practice of low-balling damage estimates has become acceptable as carriers have struggled for years with claims that have been exaggerated by policyholders and their attorneys, claims that helped push the Florida insurance market into crisis.

Field adjusters also can be “too picky,” can sometimes make assumptions about policy coverage that have to be corrected, or they may confuse one policy with another, insurer advocates and executives have argued.

Officials with one insurance carrier, Universal Property & Casualty, based in Fort Lauderdale, last year flat-out denied that the company had ever altered independent adjusters’ reports. That sparked a quick response from some plaintiffs’ lawyers. Attorney Robert Jameson, of Jacksonville, said he has taken the deposition of one Universal claims examiner who admitted that an estimate had been revised but the independent field adjuster’s name was left on the report.

State Rep. Bob Rommel, the chair of the House Commerce Committee where the controversy began a year ago, said he had asked Mandell and the other adjusters to provide his office with documentary evidence. They did that, and Rommel said he turned the information over to DFS. He does not know where the investigation stands now.

But Rommel also noted that an investigation could take time to verify the documentation. The damage provided estimate reports were photocopies and he did not know if they could be authenticated.

In the future, he said, SB 7052 will make it easier for regulators to crack down on insurers who engage in similar, misleading actions.

“We did address that, and insurance companies will be punished for that, going forward,” Rommel said. “We need a healthy, non-fraudulent insurance market in Florida.”

Was this article valuable?

Here are more articles you may enjoy.

These Five Technologies Increase The Risk of Cyber Claims

These Five Technologies Increase The Risk of Cyber Claims  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus  Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case